- Article Summary

-

As the foundation of food systems, rural livelihoods, and global biodiversity, the agriculture sector is increasingly at the center of the ESG conversation. From soil degradation to labor rights and supply chain transparency, stakeholders are calling for measurable, science-based progress. This article explores five critical ESG trends driving transformation in agriculture for 2024 and beyond.

Regenerative Agriculture and Soil Health

The shift from conventional to regenerative agriculture is accelerating. Farmers, agribusinesses, and food companies are recognizing the need to restore soil health, increase biodiversity, and build long-term climate resilience.

Practices include:

- No-till and cover cropping to prevent erosion.

- Crop rotation and agroforestry to support biodiversity.

- Soil carbon sequestration and monitoring.

| Practice | Adoption Rate (2024, Global Avg.) | Carbon Sequestration Potential |

|---|---|---|

| No-till farming | 38% | High |

| Cover cropping | 44% | Medium–High |

| Crop rotation | 52% | Medium |

| Agroforestry | 19% | High |

Sustainable sourcing programs increasingly require these practices for certification and market access.

Water Use and Climate Resilience

Agriculture accounts for over 70% of global freshwater withdrawals. With rising temperatures and erratic rainfall, efficient water use and climate adaptation are top ESG priorities.

Key initiatives:

- Drip irrigation and soil moisture sensors.

- Drought-resistant seed development.

- Satellite-based climate risk monitoring.

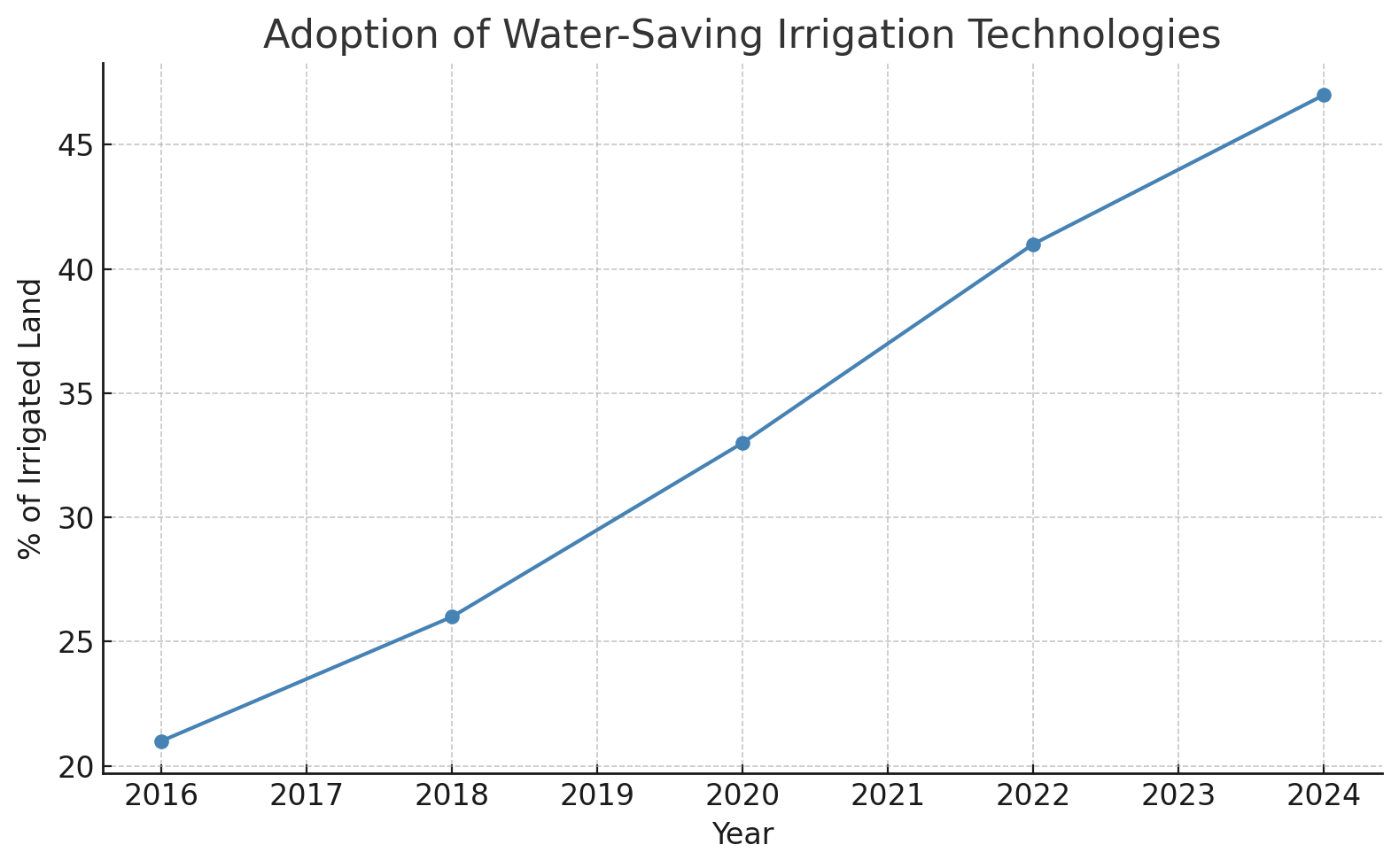

Irrigated Land Using Water-Saving Technology (% of Total Irrigated Land)

Year | Share

----------|-------

2016 | 21%

2018 | 26%

2020 | 33%

2022 | 41%

2024 (E) | 47%

Investors and insurers are now assessing water and climate risk exposure as part of ESG due diligence.

Social Equity and Labor Conditions

Agricultural labor remains one of the most vulnerable segments globally. ESG scrutiny is growing around working conditions, fair wages, and community development in rural areas.

Focus areas:

- Enforcing fair labor standards in supply contracts.

- Promoting land rights and access for women and smallholders.

- Investing in rural healthcare and education.

| Social Indicator | Global Average | ESG-Committed Producers |

|---|---|---|

| Certified Fair Labor (%) | 28% | >60% |

| Women Landowners (%) | 19% | >35% |

| Child Labor Risk Reduction (%) | – | 100% (certified schemes) |

Governments are increasingly tying agricultural subsidies and trade preferences to social compliance metrics.

Governance, Traceability, and Compliance

Regulatory pressure is rising around deforestation, biodiversity loss, and land-use transparency. In 2024, strong governance systems are essential to maintain export eligibility and investor confidence.

Major developments:

- Adoption of blockchain and geospatial data for product traceability.

- Implementation of due diligence laws such as the EU Deforestation Regulation (EUDR).

- Cross-sector coalitions for deforestation-free supply chains.

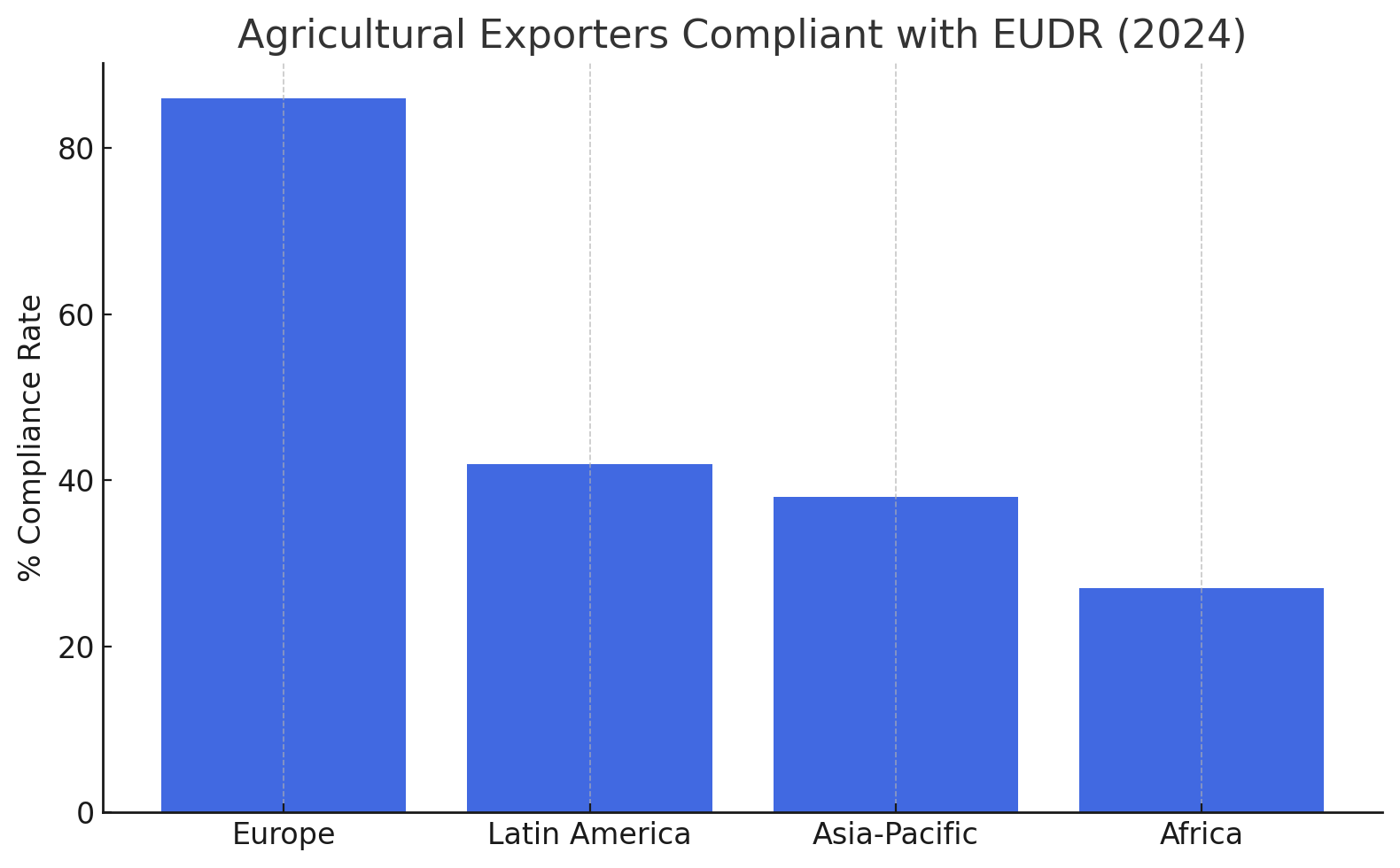

Agricultural Exporters Compliant with EUDR (Estimated Share)

Region | Compliance Rate (2024)

---------------|------------------------

Europe | 86%

Latin America | 42%

Asia-Pacific | 38%

Africa | 27%

Brands that cannot verify land-use impact face increased regulatory, reputational, and market access risks.

ESG-Linked Finance and Certification Systems

Access to capital is increasingly contingent on demonstrable ESG performance. Farmers and producers are turning to certification systems and sustainability-linked finance as tools for competitiveness and resilience.

Developments include:

- Sustainability-linked loans (SLLs) tied to yield quality, emissions, or biodiversity.

- Verified carbon farming credits and ecosystem service payments.

- Adoption of third-party standards such as Rainforest Alliance, Fair Trade, and GlobalG.A.P.

| ESG Instrument/Tool | 2024 Adoption Level |

|---|---|

| Sustainability-linked loans | High (Agri-exporters) |

| Carbon credit verification | Medium |

| Certified sustainable farming | Growing rapidly |

As EU and U.S. green finance rules evolve, ESG disclosures and third-party assurance will become prerequisites for agri-finance and trade.

Conclusion: Planting the Seeds of Accountability

Agriculture’s ESG transformation is no longer optional—it is necessary for long-term food security, ecological stability, and economic inclusion. Producers and agribusinesses that embrace ESG will not only gain access to markets and capital, but also help build a food system that is resilient, just, and climate-smart.

In 2024 and beyond, the most successful agricultural players will be those who grow not just crops—but credibility and trust.

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.