- Article Summary

-

Overview

Among the pivotal outcomes of the UN Climate Change Conference in Glasgow (COP26) was the formation of the Glasgow Financial Alliance for Net Zero (GFANZ), which many herald as a potential game changer in the fight against climate change. GFANZ is a coalition of hundreds of the world’s leading financial institutions committed to aligning their lending, investment, and insurance portfolios with the goal of net-zero greenhouse gas emissions by 2050. In this business-focused overview, we examine GFANZ’s mission and origin, the critical role of financial institutions in achieving net zero, the key initiatives and frameworks under the GFANZ umbrella, its impact on global finance and sustainability practices, as well as the challenges it faces and the future outlook. This authoritative guide is designed for business professionals seeking to understand how GFANZ is driving sustainable finance, shaping net-zero commitments, and enhancing climate risk management across the financial industry.

GFANZ’s Mission and Background

GFANZ stands for the Global Financial Alliance for Net Zero, an international alliance launched in 2021 to mobilize the financial sector towards achieving net-zero emissions by mid-century. Officially announced in the lead-up to COP26 by former Bank of England Governor Mark Carney (the UN Special Envoy on Climate Action and Finance) and supported by UN agencies, GFANZ has rapidly grown to unite over 500 financial firms across 45 countries, together controlling around $130 trillion in assets. This represents roughly 40% of global private financial assets, indicating the alliance’s extensive reach in the sector.

The mission of GFANZ is to ensure a high degree of commitment and coordinated effort by financial institutions on climate action. In broad terms, GFANZ aims to accelerate the decarbonization of the world economy by aligning finance with the goals of the Paris Agreement. Member institutions pledge to transition their financed emissions (i.e. the emissions from their lending and investment portfolios) to net zero by 2050, with meaningful intermediate targets for 2030 or sooner. To turn these commitments into action, GFANZ provides a practitioner-led forum for collaboration and knowledge sharing, helping financial firms mainstream sustainable finance practices and develop credible transition strategies.

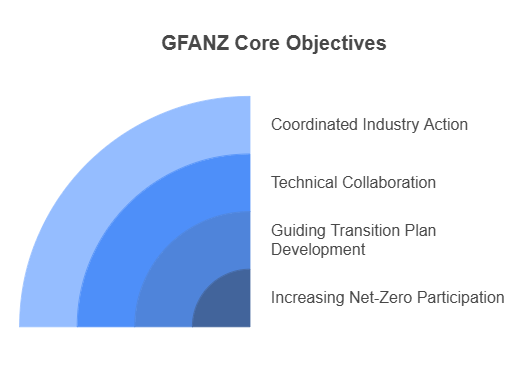

Core objectives

- Increasing Net-Zero Participation: Broadening the number of banks, asset managers, insurers, and other financial institutions committing to net-zero targets. GFANZ was intentionally designed as an umbrella initiative to bring together diverse subsectors of finance under a common climate ambition.

- Guiding Transition Plan Development: Encouraging and guiding members to design ambitious, science-based transition plans that align their business strategies with a 1.5°C climate scenario. This includes developing frameworks and tools to help firms operationalize their net-zero commitments.

- Technical Collaboration: Facilitating cooperation among members on technical challenges—such as developing methodologies for measuring financed emissions or approaches to finance green projects—to increase net-zero-aligned financing across the industry. By pooling expertise, GFANZ helps lower barriers to innovation in climate finance and risk management.

- Coordinated Industry Action: Leading collective action in the financial industry to send powerful market signals and support the global economic transition to net zero. GFANZ coordinates with initiatives like the UN Race to Zero campaign and works to align its guidance with emerging climate disclosure standards (such as TCFD and now ISSB standards) to amplify its impact across both private and public sectors.

In essence, GFANZ’s mission is to transform sustainable finance from a niche effort into a mainstream, unified movement, ensuring that financial flows worldwide become consistent with achieving net-zero emissions.

The Role of Financial Institutions in Achieving Net Zero

Financial institutions are pivotal in the decarbonization process, influencing which industries and projects receive funding. Their financed emissions often surpass their operational emissions, making portfolio alignment a crucial factor in reducing global greenhouse gas levels. As key intermediaries in economic activity, banks, asset managers, insurers, and institutional investors have the ability to shift capital away from high-emission industries and toward sustainable, low-carbon solutions. By integrating climate considerations into their decision-making, financial institutions can encourage corporations to adopt environmentally responsible strategies, fostering a systemic transition to a net-zero economy. Moreover, financial entities play a fundamental role in climate risk management, assessing potential financial exposure to climate-related disruptions and adjusting their investment and lending frameworks accordingly. This proactive approach not only mitigates economic risks associated with climate change but also drives the development of innovative financial products, such as green bonds and sustainability-linked loans, that support the global push toward decarbonization.

Key Initiatives and Frameworks under GFANZ

One of GFANZ’s strengths is that it serves as an umbrella coalition, bringing together several sector-specific net-zero initiatives and frameworks under one roof. By uniting these alliances, GFANZ fosters coherence and collective momentum across the entire financial industry.

Key initiatives under the GFANZ umbrella include:

- Net-Zero Banking Alliance (NZBA): Establishes climate-aligned lending and investment standards for banks.

- Net-Zero Asset Owners Alliance (NZAOA): Encourages pension funds and insurers to decarbonize their investment portfolios.

- Net-Zero Insurance Alliance (NZIA): Integrates net-zero strategies into underwriting and risk management practices.

- Net-Zero Investment Consultants Initiative (NZICI): Supports institutional investors in incorporating climate risk into their investment decisions.

- Net-Zero Financial Service Providers Alliance (NZFSPA): Aligns stock exchanges, credit rating agencies, and audit firms with net-zero goals.

- Paris Aligned Asset Owners (PAAO): Ensures that investment strategies remain consistent with the Paris Agreement.

These initiatives collectively provide the necessary frameworks for financial institutions to align their operations with net-zero commitments, ensuring a coordinated effort across the global financial sector.

Beyond convening these alliances, GFANZ has issued guidance documents to help financial institutions implement their net-zero commitments effectively. Its publications include frameworks for financial institutions’ transition planning, sector-specific pathways to align investments with decarbonization goals, and guidelines for measuring portfolio alignment with climate targets. Additionally, GFANZ provides recommendations for phasing out high-emitting assets in a structured and responsible manner, emphasizing strategies that balance climate impact with financial stability.

GFANZ and NZBA: Strengthening the Net-Zero Transition

The Net-Zero Banking Alliance (NZBA) has been a cornerstone initiative within GFANZ, mobilizing the global banking sector towards net-zero commitments. As one of the most influential financial subgroups under GFANZ, NZBA members pledge to align their financing activities with net-zero emissions by 2050 or sooner, establish interim targets for 2030 based on science-based methodologies, and disclose their progress transparently through standardized reporting frameworks. These commitments aim to steer banks away from financing fossil fuel-intensive industries and toward investments in green finance, renewable energy, and sustainable infrastructure.

NZBA’s role extends beyond individual bank commitments; it fosters collective industry action, setting best practices for integrating climate considerations into banking operations. Through collaboration with regulators, climate experts, and financial institutions, NZBA has driven the development of climate risk assessment models and transition finance strategies. However, despite its progress, the initiative faces challenges, particularly in emerging markets where economic stability concerns complicate the rapid shift away from carbon-intensive investments. As NZBA continues to evolve, ensuring an equitable and practical transition while maintaining financial resilience will be critical to achieving its long-term climate objectives.

Challenges and Future Outlook

Political Shifts and NZBA Withdrawals

The future of GFANZ, particularly the Net-Zero Banking Alliance (NZBA), stands at a crossroads as political dynamics shift under the Trump administration and the growing influence of EU right-wing movements. The Trump administration’s anticipated hostility toward ESG frameworks has already prompted major U.S. banks to exit NZBA, fearing regulatory or public backlash. Similarly, in the EU, right-wing factions, wary of aggressive climate mandates, may leverage this moment to push their own financial institutions toward disengagement, threatening the alliance’s unity and global reach.

Opportunities Amid Challenges

Despite these setbacks, the unraveling of NZBA’s membership could catalyze a redefinition of its purpose. European banks and steadfast NZBA participants have a chance to double down on their climate commitments, positioning the EU as a beacon of leadership in the net-zero transition while the U.S. steps back. This divergence could strengthen the resolve of remaining members to develop more robust, transparent standards, countering accusations of greenwashing and proving that financial institutions can align profit with planetary goals even under political pressure.

Adaptation and Long-Term Stakes

The path forward for GFANZ will depend on its ability to adapt to these disruptions without losing sight of its core mission. Striking a balance between maintaining broad participation and upholding ambitious climate targets will be critical, especially as political headwinds test the resilience of global cooperation. Whether GFANZ emerges as a revitalized force for decarbonization or a weakened coalition vulnerable to dilution remains uncertain, but its response to this moment will shape the trajectory of climate finance—and the planet’s future—for decades to come.

Why Work With ASUENE USA Inc?

In today’s rapidly evolving financial landscape, sustainable finance and net-zero commitments are becoming central to corporate strategy. As financial institutions worldwide align with the Global Financial Alliance for Net Zero (GFANZ), businesses must adapt to growing expectations for climate risk management, emissions disclosure, and sustainable investment. That’s where ASUENE USA Inc. comes in.

Our one-stop sustainability solution supports businesses in aligning with Global standards by streamlining data collection, facilitating third-party verifications, and providing expert consulting.

Download our Latest White Paper!