- Article Summary

-

Introduction: The Economics of a Greener Grid

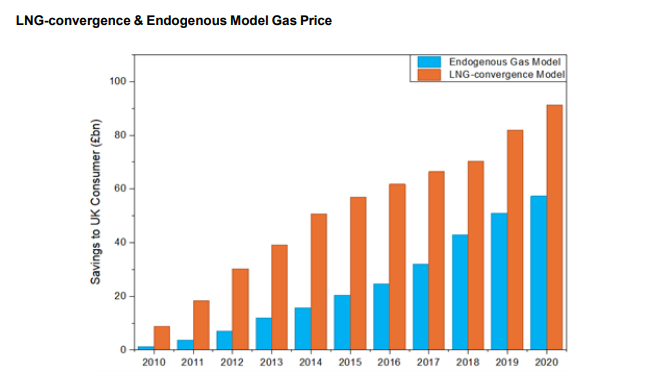

The transition to renewable energy has entered a new economic phase. According to a new study by University College London (UCL), the UK saved around £104 billion since 2010 due to wind power generation lowering wholesale electricity prices. This finding challenges long-standing perceptions that renewable energy is expensive or reliant on subsidies. Instead, the data shows that wind generation delivers tangible cost savings to consumers, businesses, and the national economy.

As global energy markets remain volatile, the economic rationale for decarbonizing power systems is becoming stronger. For investors and corporations, renewables have evolved from a climate imperative to a financial strategy. A cleaner grid supports competitiveness, shields businesses from fuel price spikes, and attracts ESG-focused capital. The connection between carbon reduction and financial performance is now measurable and strategic.

Falling Costs, Rising Returns: The Wind Advantage

Over the past decade, the Levelized Cost of Electricity (LCOE) for wind energy has declined sharply, while the cost of natural gas-based power has remained highly volatile. Technological advancements, supply chain maturity, and large-scale offshore projects have driven down the cost per megawatt-hour for wind. In contrast, fossil fuels remain tied to global commodity fluctuations and carbon pricing risks.

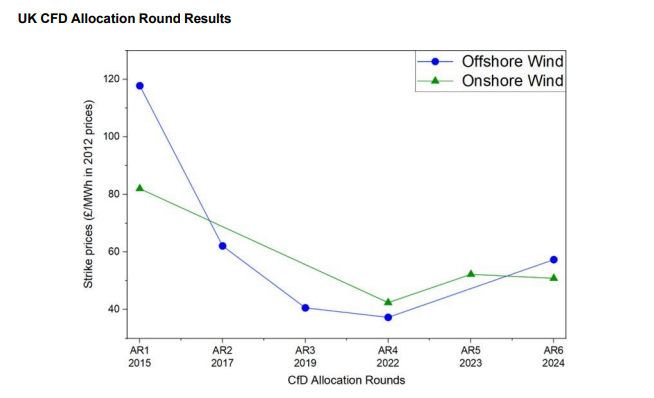

This economic transformation has a market-wide effect. As more wind energy enters the grid, it displaces high-cost gas generation, leading to the “merit order effect” where wholesale prices drop. The UK, now one of the world’s leaders in offshore wind capacity, has demonstrated how scaling renewables can reshape the economics of power generation. With clear policy direction and predictable contracts such as the UK’s Contracts for Difference (CfD) scheme, wind energy is no longer a financial risk but a market stabilizer.

Price Stability and Energy Security: Renewables as a Hedge

The geopolitical and economic disruptions of recent years, especially the surge in fossil fuel prices following the conflict in Ukraine, have underscored the vulnerability of energy systems reliant on imported fuels. Renewable power, by contrast, offers insulation from such volatility. Wind and solar have zero fuel costs, providing long-term stability in electricity pricing and reducing dependence on imported energy sources.

Corporations are increasingly turning to Power Purchase Agreements (PPAs) with renewable producers to lock in predictable electricity costs over 10 to 20 years. This approach aligns with ESG risk management principles, offering both price certainty and emissions reductions. For governments, integrating renewables strengthens national energy security and reduces exposure to global supply shocks.

Competitiveness and Capital: Decarbonization as Industrial Strategy

Beyond reducing costs, renewable energy enhances the competitiveness of entire industries. Cheaper and cleaner electricity lowers production costs for energy-intensive sectors such as manufacturing, logistics, and data centers. This advantage attracts global investment, especially from ESG-oriented funds that prioritize stable, low-carbon economies.

The UK’s renewable sector illustrates how decarbonization can stimulate local economies. Offshore wind manufacturing hubs in regions like Hull and Teesside are revitalizing industrial areas, creating jobs, and establishing new export opportunities. Similar strategies are emerging globally as nations realize that renewable infrastructure drives both economic growth and sustainability. The intersection of finance, policy, and climate strategy has become a defining feature of 21st-century industrial planning.

Conclusion: Investing in the Future of Energy

The evidence is clear. Decarbonizing power systems delivers financial, social, and environmental dividends. The UCL findings confirm that wind energy lowers costs and strengthens energy security, proving that renewables are a foundation for economic resilience.

For investors, the message is equally compelling. The transition to renewable power represents a structural shift in value creation, one that aligns long-term returns with global sustainability goals. For corporations, accurate carbon and cost accounting will be key to capturing the benefits of this transformation. ASUENE advocates for data-driven decision-making that connects emissions performance to financial outcomes. The future of energy is not only cleaner but also smarter, more competitive, and economically sustainable.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

Through its energy management system NZero, ASUENE provides SMEs with the practical tools to make the most of EU funding for energy efficiency. NZero combines advanced technology, consulting services, and an extensive partner network to help companies achieve their net-zero goals. By choosing ASUENE, SMEs gain not only access to reliable carbon accounting but also a powerful EMS platform designed to unlock energy savings and long-term sustainability success.