- Article Summary

-

Overview

The European Sustainability Reporting Standards (ESRS) are a cornerstone of the EU’s Corporate Sustainability Reporting Directive (CSRD), signaling a transformative shift in how companies disclose non-financial information. Designed to improve transparency, accountability, and comparability of ESG data, the ESRS framework represents a new era of sustainability reporting that affects thousands of companies within and beyond Europe. As of 2025, the clock is ticking, and businesses must understand the timeline to ensure timely compliance. This article outlines the ESRS implementation timeline, key milestones, and what each phase means for organizations globally.

The Origins of ESRS and Its Link to CSRD

The ESRS was developed by the European Financial Reporting Advisory Group (EFRAG) under the mandate of the European Commission. It serves as the reporting backbone for the CSRD, which was officially adopted in late 2022. The CSRD replaces the older Non-Financial Reporting Directive (NFRD), a framework that was widely criticized for lacking clarity and comparability. The CSRD, by contrast, aims to ensure consistent, transparent, and comprehensive sustainability reporting across the EU.

One of the most striking differences between the two directives is the scale of their applicability. While the NFRD applied to roughly 11,700 large public-interest entities, the CSRD dramatically expands this scope to cover over 50,000 companies across the EU, including listed small- and medium-sized enterprises (SMEs), as well as certain large non-EU companies with significant business activity in the EU. The ambition behind this expansion is to make sustainability data not only more accessible but also more usable for investors, policymakers, and stakeholders at large.

Moreover, the CSRD integrates with other key initiatives such as the EU Green Deal and Sustainable Finance Disclosure Regulation (SFDR), reinforcing the EU’s overarching strategy to mainstream ESG considerations into the financial and corporate ecosystem. ESRS provides the standardized framework that makes this possible, and as seen in the 2025 updates, continues to evolve with a focus on usability, simplification, and alignment with global standards.

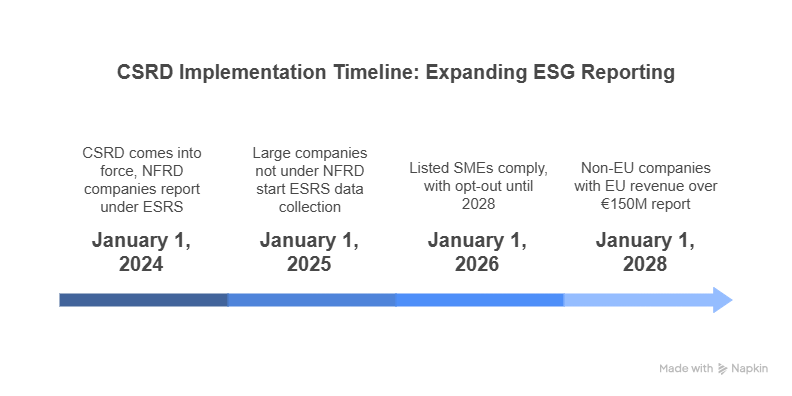

Key Implementation Dates: A Year-by-Year Breakdown

Understanding the phased rollout of the ESRS is essential for effective compliance. Below is a breakdown of the critical dates and obligations:

January 1, 2024: The CSRD comes into force. Companies already subject to the NFRD (mainly large public-interest entities with over 500 employees) must begin reporting under ESRS for FY2024, with reports due in 2025.

January 1, 2025: Large companies not previously covered by NFRD (more than 250 employees and/or €40M turnover and/or €20M in assets) must start collecting ESRS data for FY2025, with disclosures due in 2026.

January 1, 2026: Listed SMEs (except micro-enterprises) must comply, although they benefit from a possible opt-out until 2028. This phase significantly broadens the reporting landscape to include smaller market players.

January 1, 2028: Non-EU companies generating over €150M in annual EU revenue and with at least one subsidiary or branch in the EU will be required to report on their ESG performance using ESRS, marking a crucial expansion to global firms.

Latest 2025 Updates: Sector Standards, Simplification and Materiality Clarity

As of June 2025, the European Commission and EFRAG have released updated guidance designed to dramatically streamline the ESRS framework. These include:

- A 50% reduction in the number of mandatory data points, significantly decreasing the reporting burden for companies.

- Simplification of the Double Materiality Assessment process, allowing businesses to more efficiently determine what information is both financially and impact-material.

- Improved clarity and understandability of the standards overall, aimed at eliminating ambiguities and easing interpretation for reporting teams.

In parallel, sector-specific ESRS standards (piloted in the banking, oil & gas, and agriculture sectors) continue to develop, providing tailored disclosures that increase relevance and comparability. EFRAG has also provided updated guidance on interoperability with frameworks such as ISSB and GRI, enabling companies already reporting to global standards to reduce duplication and align efforts.

EFRAG will submit its final advice on these updates to the European Commission by October 31, 2025. The updated ESRS rules, reflecting the June 2025 simplifications, are expected to apply for reports covering the 2027 financial year, with early adoption permitted for 2026.

What the Timeline Means for Businesses

For companies both inside and outside the EU, the phased ESRS timeline offers both challenges and strategic opportunities:

- Early adopters (2024) are already setting benchmarks and defining best practices.

- Mid-phase companies (2025–2026) have a short runway to align data systems, train teams, and conduct materiality assessments.

- Global entities (2028) must begin preparations now, especially if they generate significant revenue in the EU.

With the June 2025 updates now in focus, businesses should conduct a gap analysis against the streamlined ESRS requirements, review their current disclosures for opportunities to simplify, and stay informed on draft standards and public consultations between July and September 2025. The reduction in data points and clearer materiality guidance offer a timely chance to reduce administrative overhead while improving report quality.

Staying flexible and future-ready will be essential. Companies should anticipate further refinements and ensure their systems can adjust to new guidance that better reflects global ESG expectations.

Conclusion

The ESRS timeline is more than a compliance calendar, it’s a roadmap for embedding sustainability into the core of business strategy. The June 2025 updates mark a critical moment, making the framework more practical and globally aligned. Each phase brings new expectations, but also opportunities to lead in transparency, stakeholder trust, and long-term value creation. As the EU sets a new global benchmark for ESG reporting, businesses that act early and strategically will be best positioned for success in a rapidly evolving regulatory landscape.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.