- Article Summary

-

As environmental and social concerns continue to reshape global markets, the manufacturing industry stands at a critical inflection point. From raw material sourcing to end-of-life product management, manufacturers are being called upon to adopt more transparent, resilient, and sustainable business models. This article explores five major ESG (Environmental, Social, and Governance) trends driving transformation in the sector today.

The Rise of Circular Manufacturing

The circular economy is fast becoming the cornerstone of ESG strategies in manufacturing. Instead of the traditional linear model—produce, use, discard—companies are embracing a regenerative approach aimed at minimizing waste and maximizing resource efficiency.

Key Developments:

- Material recovery and reuse: Leading manufacturers are investing in closed-loop systems.

- Product-as-a-service (PaaS) models: Some equipment makers now lease products with full-service maintenance and end-of-life take-back options.

Examples of Circular Initiatives by Leading Manufacturers

| Company | Circular Strategy | ESG Impact |

|---|---|---|

| Philips | “Healthy People, Sustainable Planet” | 100% of new products designed for recycling |

| Unilever | Refillable packaging in 30+ markets | Reduces plastic use by over 100,000 tons |

| Siemens | Remanufacturing of turbines and motors | Cuts raw material usage by 60% |

Low-Carbon Manufacturing and Energy Innovation

Decarbonization is perhaps the most pressing environmental goal within manufacturing. Regulatory pressure and investor demand are pushing companies to cut emissions across Scopes 1, 2, and increasingly Scope 3.

Major Initiatives:

- Electrification of industrial processes

- Green hydrogen for high-heat applications

- Adoption of on-site renewable energy

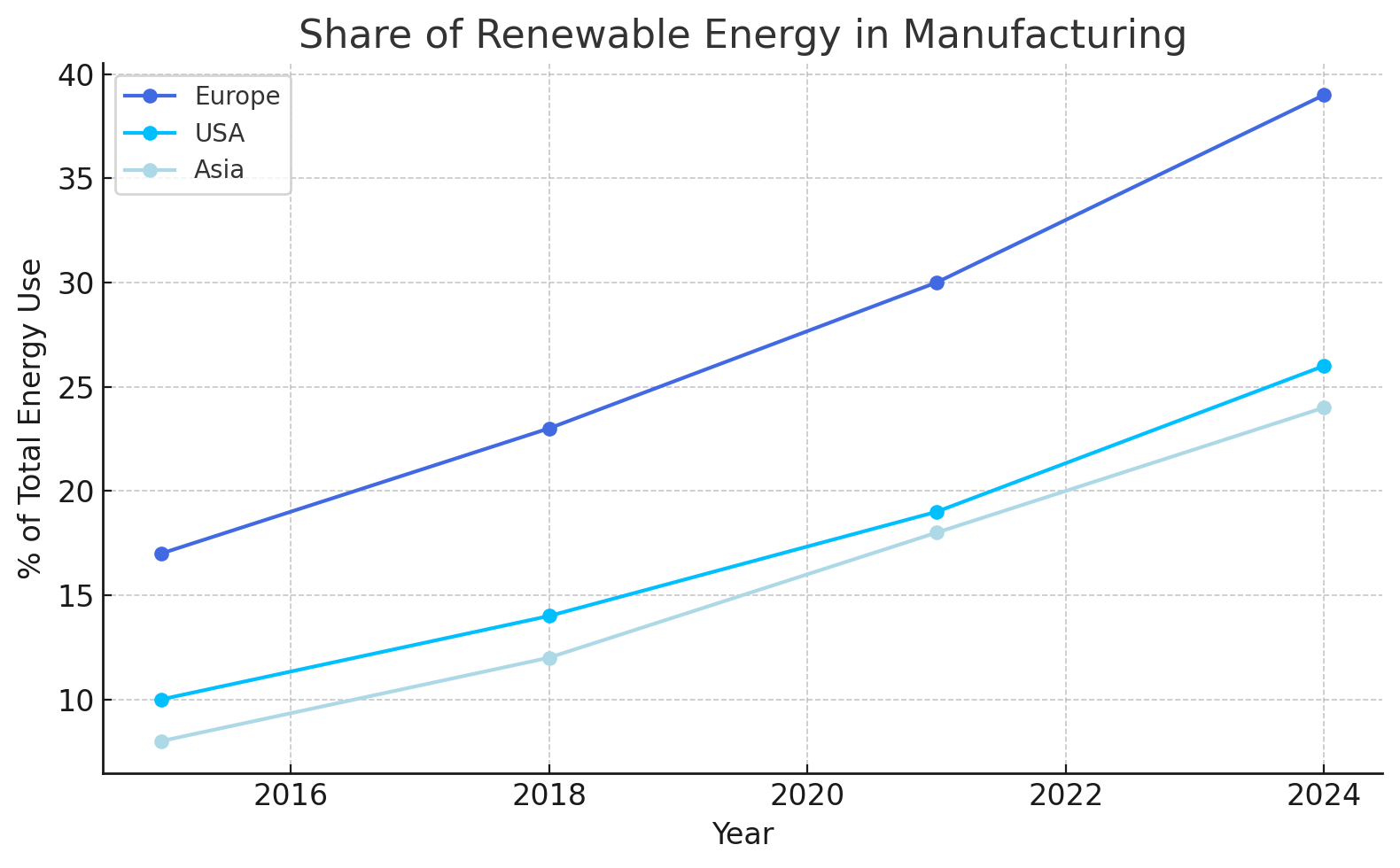

Share of Renewable Energy in Manufacturing (% of total energy use)

Year | 2015 | 2018 | 2021 | 2024 (Est.)

-------|------|------|------|--------------

Europe | 17% | 23% | 30% | 39%

USA | 10% | 14% | 19% | 26%

Asia | 8% | 12% | 18% | 24%

Regulatory Note:

The EU’s Carbon Border Adjustment Mechanism (CBAM) and the U.S. Inflation Reduction Act (IRA) have catalyzed rapid investment in green production facilities.

Supply Chain Transparency and ESG Due Diligence

With the rise of legislation such as the EU Corporate Sustainability Due Diligence Directive (CSDDD) and Germany’s Supply Chain Act, manufacturers must now assess and report on the sustainability of their entire supply network.

Key Practices:

- Supplier ESG scorecards

- Blockchain for traceability

- LCA (Life Cycle Assessment) integration in procurement

Table 2: ESG Due Diligence Adoption Rates by Region (2024)

| Region | % of Manufacturers Conducting ESG Audits |

|---|---|

| EU | 85% |

| North America | 72% |

| Asia Pacific | 64% |

| LATAM | 47% |

Manufacturers are now expected to move from reactive compliance to proactive ESG engagement with suppliers, ensuring ethical labor practices and environmental integrity.

Workforce Equity and the Social Pillar

The “S” in ESG is gaining prominence, especially as labor shortages and generational workforce shifts redefine employer-employee relationships. Companies are expected not only to provide safe working conditions but also to promote inclusivity, upskilling, and community engagement.

Focus Areas:

- DEI (Diversity, Equity, Inclusion) programs

- Employee well-being and mental health support

- Fair labor certification for contractors

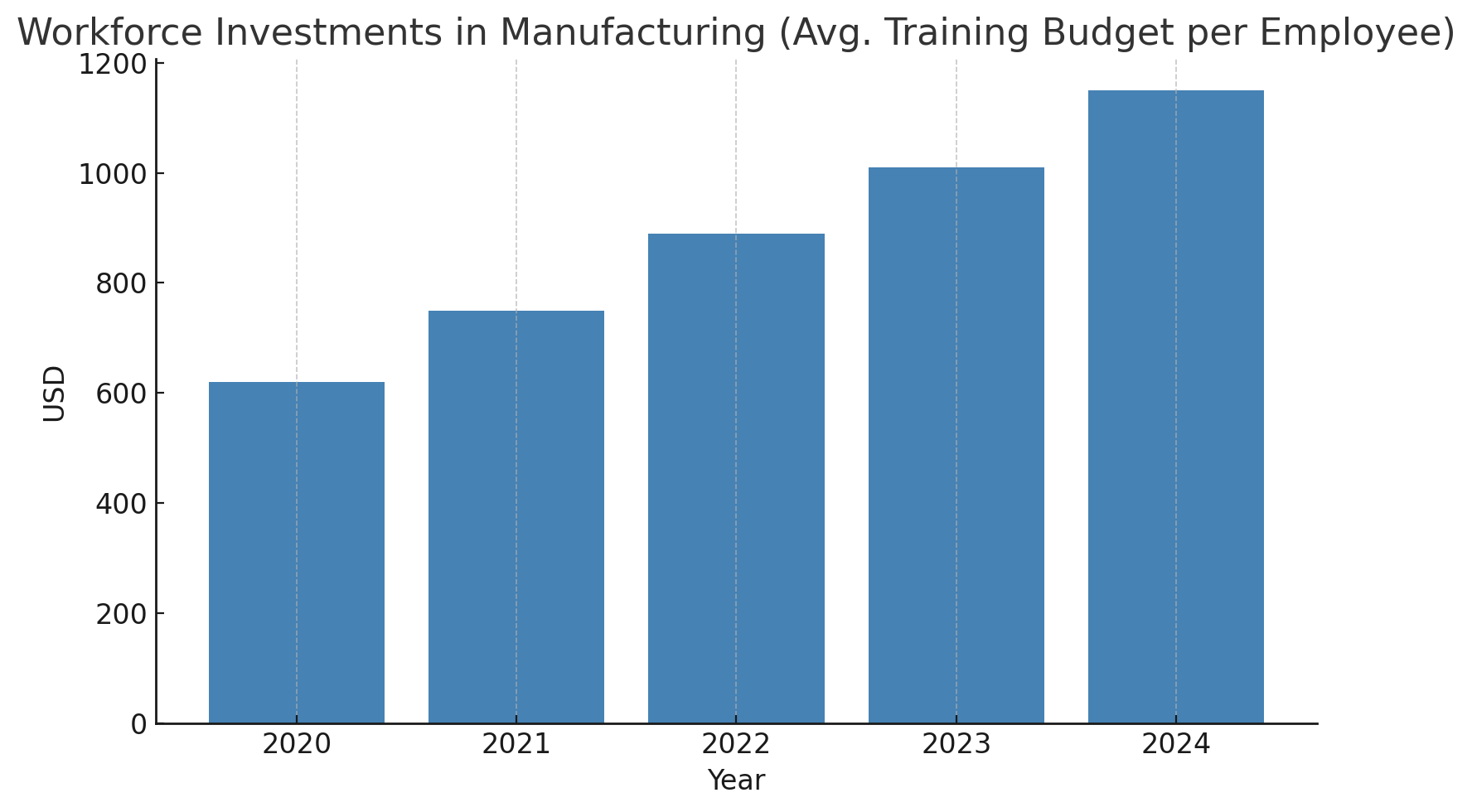

Workforce Investments in Manufacturing (2020–2024)

Year | Avg. Training Budget per Employee (USD)

----------|-----------------------------------------

2020 | $620

2021 | $750

2022 | $890

2023 | $1,010

2024 (E) | $1,150

Social metrics are increasingly tied to ESG ratings, investor confidence, and brand value.

ESG Reporting and Digitalization

The surge in ESG data disclosure is transforming the way manufacturers communicate with investors, regulators, and consumers. Digital tools are making it easier to capture, verify, and analyze ESG-related metrics.

Emerging Tools and Trends:

- AI-driven ESG analytics

- Real-time emissions tracking platforms

- Integrated ESG and financial reporting systems

ESG Reporting Standards Adoption in Manufacturing (2024)

| Standard | Adoption Rate (%) |

|---|---|

| GRI (Global Reporting Initiative) | 68% |

| SASB (Sustainability Accounting Standards Board) | 45% |

| CSRD (EU Corporate Sustainability Reporting Directive) | 52% |

| TCFD (Task Force on Climate-Related Financial Disclosures) | 41% |

As mandatory reporting becomes the norm—particularly in the EU under CSRD and in the U.S. via SEC rules—companies are streamlining their digital ESG architectures.

Conclusion

ESG in manufacturing is no longer a matter of choice; it is a competitive imperative. Companies that fail to align with ESG principles risk not only regulatory penalties but also reputational and market losses.

What emerges is a new vision—Industry 5.0, where human-centric, sustainable, and resilient manufacturing models are powered by data, equity, and environmental responsibility.

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.