- Article Summary

-

The energy sector stands at the crossroads of transformation. Long seen as a primary contributor to climate change, it is now also central to the solution. Environmental, Social, and Governance (ESG) principles are redefining how energy companies operate, invest, and report. In 2024, the pressure to deliver clean, reliable, and equitable energy is stronger than ever. This article highlights five ESG trends shaping the global energy landscape.

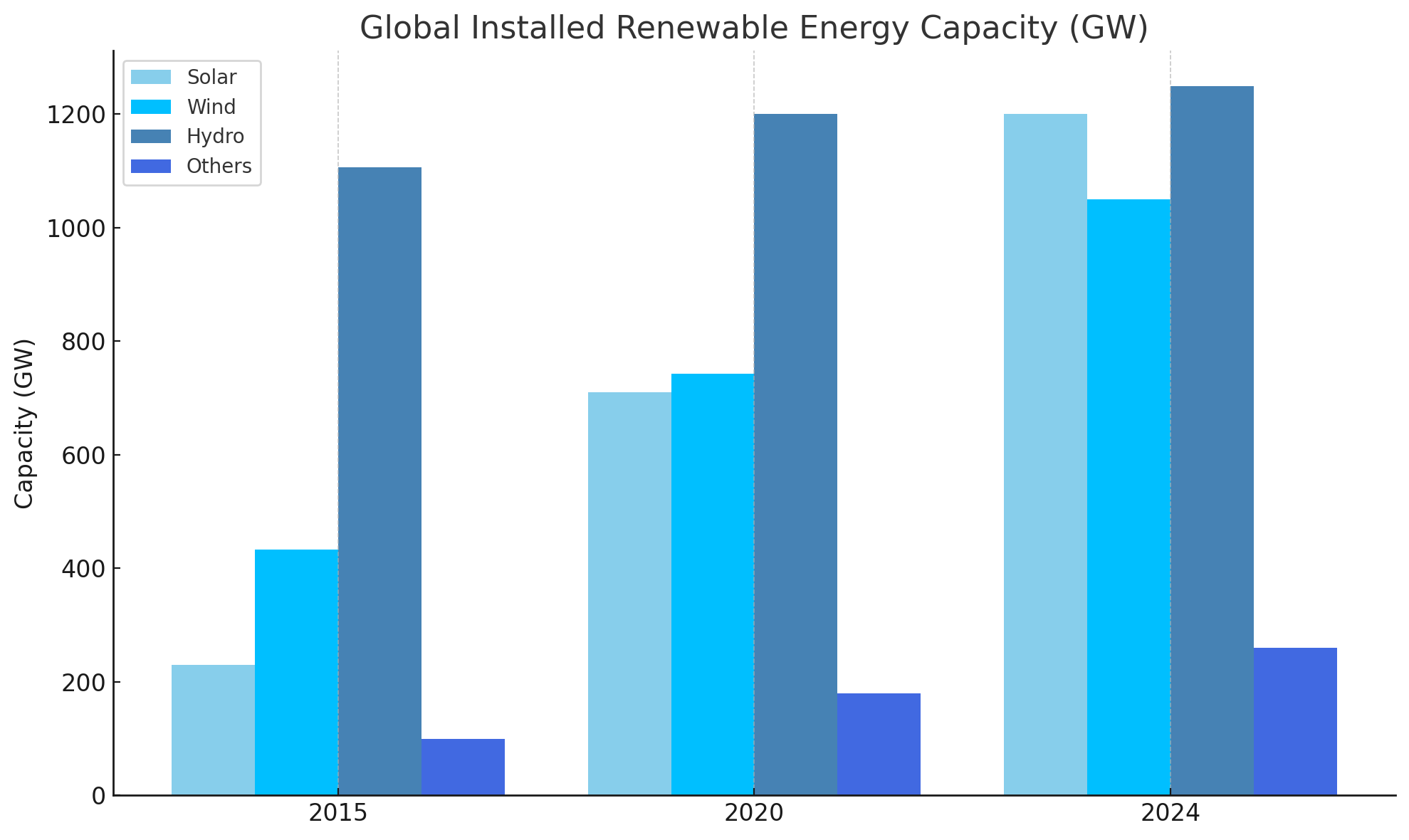

Decarbonization and the Renewable Energy Surge

In response to the climate crisis, decarbonization remains the cornerstone of ESG strategies in the energy sector. Governments and corporations are pushing for cleaner portfolios, targeting net-zero emissions by mid-century or sooner.

Major Developments:

- Growth in solar, wind, and green hydrogen investments.

- Retirement of coal-fired power plants and reduced upstream oil exploration.

- Use of carbon capture, utilization, and storage (CCUS) technologies.

Global Installed Renewable Energy Capacity (GW)

Year | Solar | Wind | Hydro | Others

------|-------|------|-------|--------

2015 | 230 | 433 | 1,107 | 100

2020 | 710 | 743 | 1,200 | 180

2024* | 1,200 | 1,050| 1,250 | 260

(*) 2024 data estimated based on IRENA projections.

Energy Access and Social Equity

Access to affordable, reliable energy is a human right and a growing ESG concern. Energy poverty continues to affect over 700 million people globally, mostly in sub-Saharan Africa and parts of Asia.

Areas of Focus:

- Off-grid solar projects and microgrids in underserved communities.

- Tiered electricity pricing models for affordability.

- Workforce inclusion in energy transition initiatives.

Social Equity Indicators in the Energy Sector

| Metric | Global Average | ESG Leader Benchmark |

|---|---|---|

| Access to Electricity (%) | 91% | 100% (EU, North America) |

| Clean Cooking Adoption (%) | 69% | 95% (Nordics, Japan) |

| Women in Energy Workforce (%) | 24% | >35% (Top 20 firms) |

Social KPIs are now embedded in many ESG-linked loans and performance-based remuneration.

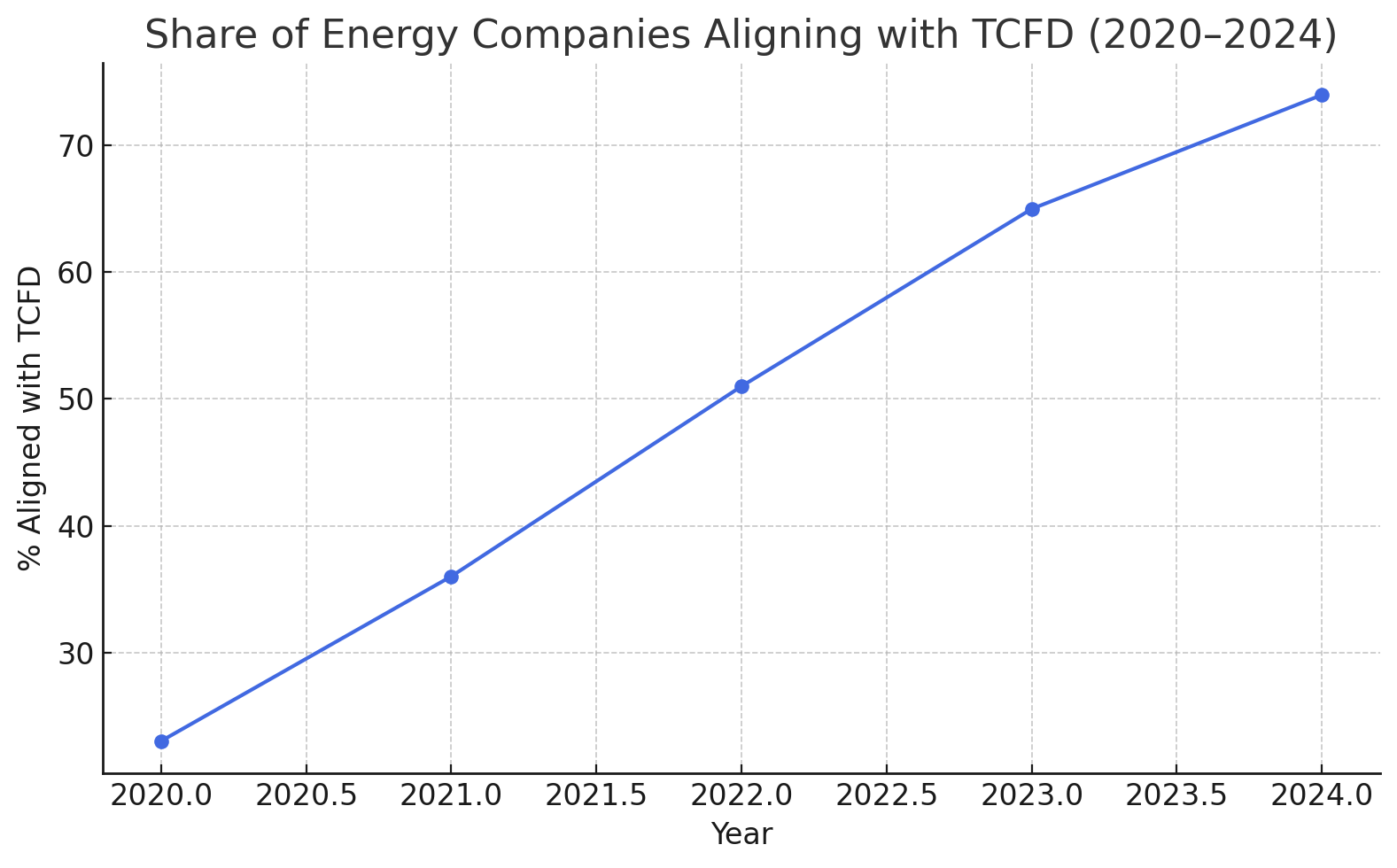

Governance, Transparency, and Climate Risk Management

Investors are demanding clearer governance structures, board accountability, and risk oversight—especially around climate-related risks.

Key Governance Trends:

- Board-level ESG committees and climate-literate directors.

- Integration of TCFD and ISSB-aligned climate disclosures.

- Transparent reporting on lobbying, tax, and executive pay.

Share of Energy Companies Aligning with TCFD (2020–2024)

Year | % Aligned with TCFD

------|---------------------

2020 | 23%

2021 | 36%

2022 | 51%

2023 | 65%

2024* | 74%

(*) 2024 data estimated from CDP and TCFD market uptake reports.

Digitalization for ESG Performance

Digital tools are playing a critical role in helping energy companies manage ESG targets and regulatory obligations.

Digital Tools in Use:

- Real-time emissions monitoring and satellite-based leak detection.

- Blockchain for energy trading and carbon offset tracking.

- Predictive maintenance via AI to reduce operational risk.

Top ESG Tech in the Energy Industry

| Technology | ESG Benefit |

|---|---|

| Smart Grids | Reduces transmission loss, enables renewables |

| Digital Twin of Assets | Enhances reliability, lifecycle sustainability |

| AI-driven Energy Forecast | Optimizes production, reduces waste |

| Remote Sensing (Drones) | Detects methane leaks, improves safety |

Digitalization enables verifiability, which is crucial as ESG assurance becomes standard under frameworks like CSRD.

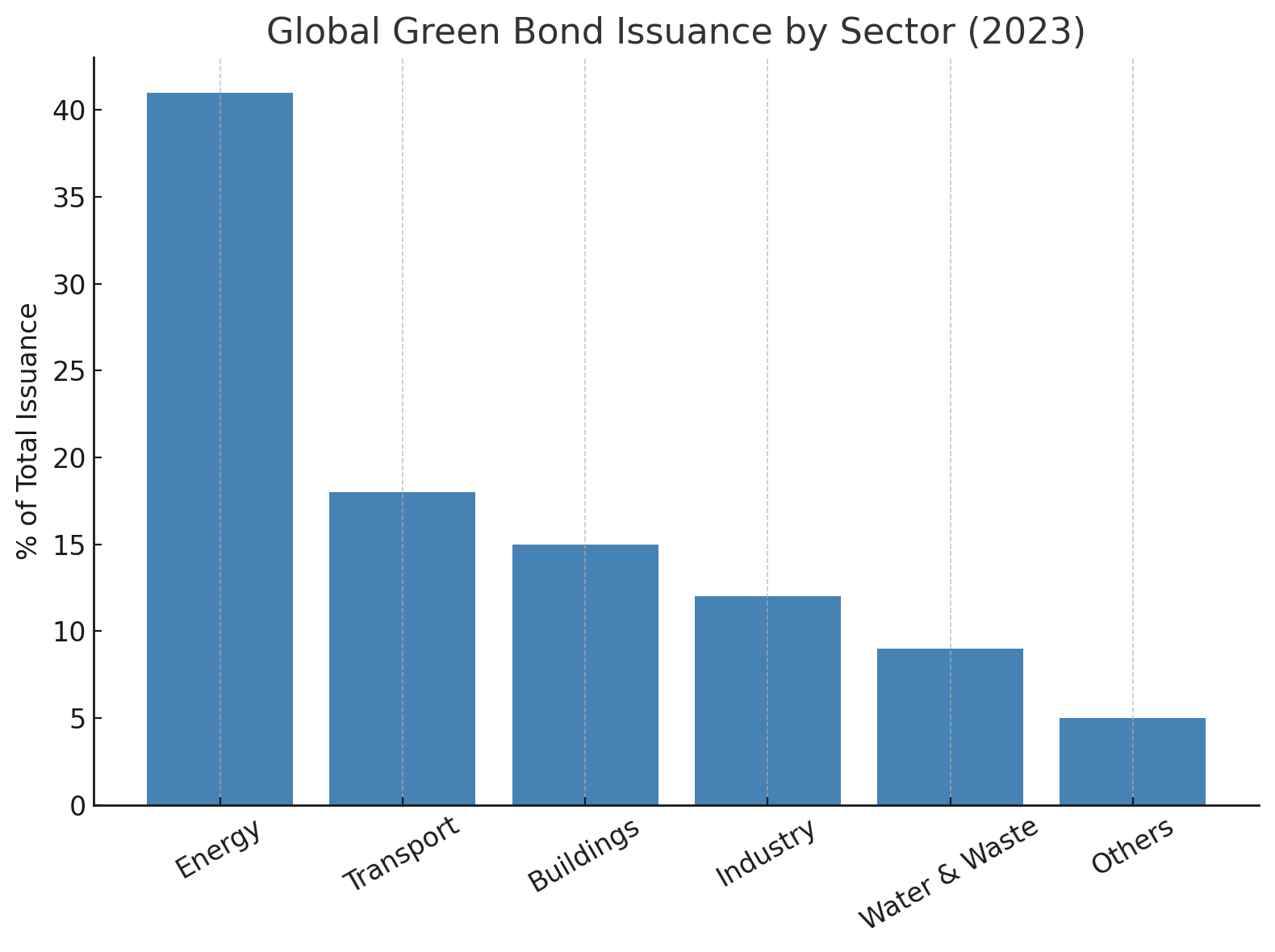

Green Finance and Sustainability-linked Investment

Capital is increasingly flowing toward projects and companies with credible ESG strategies. Green bonds, sustainability-linked loans, and ESG ETFs are reshaping energy sector funding.

Investment Trends:

- Issuance of green and transition bonds for grid upgrades, renewables, and clean fuels.

- Credit margins tied to emissions reductions or social targets.

- ESG ratings affecting cost of capital and investor inflows.

Global Green Bond Issuance by Sector (2023)

Sector | % of Total Issuance

--------------|----------------------

Energy | 41%

Transport | 18%

Buildings | 15%

Industry | 12%

Water & Waste | 9%

Others | 5%

Energy continues to lead green finance markets due to its central role in decarbonization.

Conclusion: From Transition to Transformation

The energy sector is no longer just transitioning—it is transforming. The integration of ESG is not a side project, but a strategic imperative that touches every business model, investment decision, and stakeholder relationship.

As scrutiny increases, so does opportunity. Companies that commit to credible ESG roadmaps will be rewarded with better financing, improved resilience, and long-term social license to operate.

The future of energy is not only cleaner—it is more accountable, equitable, and digitally enabled.

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.