- Article Summary

-

Overview

As sustainability reporting enters a new era, the concept of double materiality has become a central principle in European ESG regulation, especially under the Corporate Sustainability Reporting Directive (CSRD). Unlike traditional materiality, which focuses on financial risk to the company, double materiality requires companies to also assess their own impacts on the environment and society. This dual lens demands a more robust and transparent approach to ESG disclosure, particularly for organizations operating in or doing business with the EU.

What Is Double Materiality?

Double materiality expands the conventional definition of materiality by requiring two perspectives:

- Financial Materiality: How sustainability issues (like climate change or water scarcity) affect the company’s financial performance, enterprise value, or future cash flows.

- Impact Materiality: How the company’s activities impact the environment, people, and wider society, whether through emissions, labor practices, resource use, or community engagement.

Under CSRD, both dimensions must be assessed and disclosed. This marks a significant evolution from previous frameworks that prioritized investor-focused materiality only.

Why Is Europe Leading With Double Materiality?

Europe is taking the lead on double materiality because it wants companies to be more open about how they affect the planet and society, not just how they are affected by financial risks. This approach supports major EU goals like cutting carbon emissions, protecting nature, and improving social conditions.

By asking companies to report both kinds of impacts, Europe is promoting a clearer and fairer view of corporate responsibility. This helps investors make better decisions and pushes companies to reduce any harm they may cause.

To support this shift, the EU created detailed reporting standards called ESRS. These give businesses clear instructions on what and how to report. Together with the CSRD, they are setting new expectations for honest and complete sustainability reporting.

How Double Materiality Changes ESG Reporting

Double materiality changes ESG reporting by requiring companies to look at both how environmental and social issues affect their business and how their business affects the world. Instead of only focusing on financial risks, companies now have to consider a wider range of stakeholders including communities, employees, and the environment.

This means collecting more data on issues like pollution, biodiversity, human rights, and resource use, not just carbon emissions. Companies also need to understand their entire value chain, looking at both their suppliers and how their products are used or disposed of.

The shift also means that boards and executives must take greater responsibility for ESG topics, ensuring sustainability is part of major business decisions. Overall, companies are expected to be more transparent, inclusive, and strategic in how they report their sustainability performance.

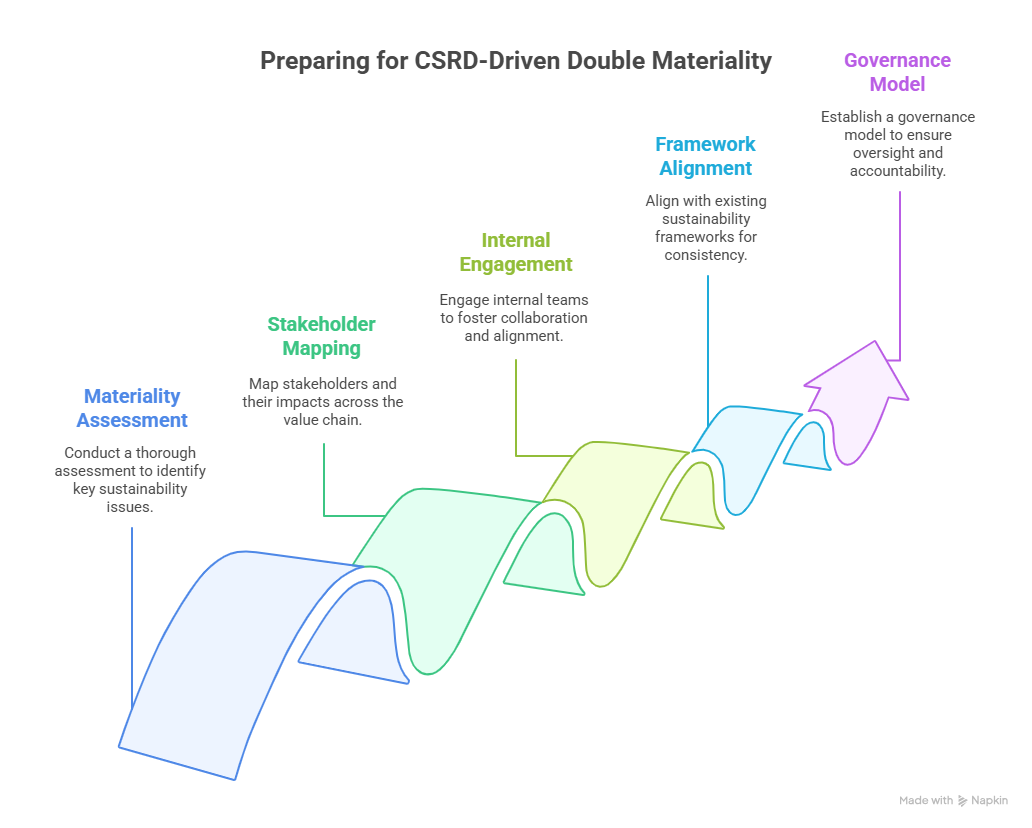

Preparing for CSRD-Driven Double Materiality

To meet CSRD expectations, companies should take the following steps:

- Conduct a double materiality assessment using the ESRS guidance

- Map stakeholders and impacts across the full value chain

- Engage internal teams across sustainability, risk, legal, procurement, HR, and finance

- Align with existing frameworks like GRI (impact lens) and TCFD/ISSB (financial lens)

- Create a sustainability governance model that ensures oversight and accountability at the executive level

Tools such as CDP, GRI, and SBTi can support data collection and alignment with CSRD-aligned standards.

Conclusion

Double materiality represents a transformative shift in sustainability reporting, placing equal emphasis on a company’s vulnerability to ESG risks and its responsibility to address them. For companies operating globally, but especially in Europe, adopting this perspective is no longer optional. It is central to regulatory compliance, stakeholder trust, and long-term strategic relevance in a sustainable economy.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting and CDP consulting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.