- Article Summary

-

Introduction

The European Union has moved decisively to address methane emissions from the energy sector, adopting the world’s first comprehensive regulation that covers not only domestic oil and gas production but also imports. At the same time, recent reporting has highlighted efforts by the United States government to seek exemptions or extended timelines for U.S. exporters, arguing that existing U.S. regulations should be treated as equivalent. This has created understandable uncertainty for American oil and gas companies that rely on the European market.

The central question many exporters are now asking is simple: do U.S. oil and gas exports still need to comply with the EU methane regulation. Despite ongoing diplomatic discussions, as of now, the answer is yes. The regulation is adopted law, and EU market expectations continue to move in the direction of greater methane transparency rather than delay. Understanding what the rules require, how they are likely to be applied, and where companies should focus their efforts is now a commercial necessity rather than a policy debate.

What the EU Methane Regulation Requires

The EU methane regulation is designed around monitoring, reporting, and verification of methane emissions across the oil and gas value chain. Methane is a short lived but highly potent greenhouse gas, and leaks from upstream production, processing, and transport represent one of the most cost effective opportunities for near term climate mitigation.

Under the regulation, operators and importers are expected to provide credible information on methane emissions associated with the oil and gas placed on the EU market. The emphasis is on transparency and data quality. Companies are not expected to eliminate emissions immediately, but they are expected to measure, report, and demonstrate progress in managing leaks over time.

Importantly, the regulation extends beyond EU borders. By covering imported oil and gas, the EU aims to avoid carbon leakage and ensure that climate ambition within the bloc is not undermined by higher emissions embedded in imports. For exporters, this means that upstream emissions data is becoming part of market access requirements, alongside price, volume, and reliability.

What Is Currently Expected From the U.S. Oil and Gas Industry

To reduce uncertainty, the expectations under the EU methane regulation can be summarized into five distinct, non overlapping requirements.

- Methane measurement: Establish monitoring of methane emissions across upstream oil and gas operations linked to EU exports, with a clear shift toward measured or monitored data.

- Emissions reporting: Disclose methane emissions data associated with oil and gas placed on the EU market using consistent and documented methodologies.

- Data verification: Ensure methane data is robust, traceable, and capable of internal or third party review.

- Commercial alignment: Integrate methane transparency into EU buyer requirements, contracting, and market access decisions.

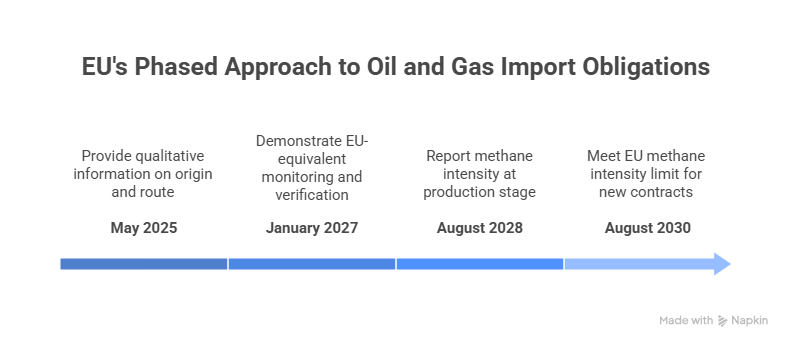

- Implementation timeline: Prepare for phased importer obligations through a step by step escalation of requirements.

Does U.S. Pushback Change the Legal Obligation?

Recent news of U.S. efforts to secure exemptions or delayed compliance has led some companies to question whether they can pause preparations. From a legal perspective, political discussions do not alter the status of an adopted EU regulation. Unless and until the law is formally amended, its requirements remain in place.

EU institutions have signaled some openness to flexibility in how compliance is demonstrated, particularly during early implementation. However, this flexibility is focused on practical pathways rather than weakening the core expectation of methane transparency. In other words, there may be room to discuss how data is provided and validated, but not whether data is required at all.

For EU buyers, utilities, and financial institutions, the regulation is already shaping procurement and risk assessment. Many are moving ahead on the assumption that methane reporting will become a standard condition for long term supply relationships. As a result, exporters that delay preparation risk being out of step with customer expectations, regardless of the outcome of diplomatic negotiations.

What Counts as Acceptable Methane Measurement and Reporting?

One of the most common questions from exporters is what level of measurement is considered acceptable. The direction of travel is clear. Generic emissions factors and high level estimates are increasingly seen as insufficient for cross border reporting.

Credible reporting is expected to be based on measured or monitored data, supported by clear methodologies and documentation. Consistency across facilities and supply chains matters, as does the ability to verify data through internal or third party review. While the regulation recognizes that measurement approaches will evolve, it places clear value on continuous improvement and transparency.

This focus reflects a broader shift in climate governance. Emissions data is no longer treated as a theoretical exercise. It is becoming operational information that informs procurement decisions, investment risk, and regulatory confidence.

Is Waiting a Lower Cost Strategy?

Some companies may view the current political debate as an opportunity to wait. In practice, waiting often increases long term exposure. Delayed action compresses timelines, limits technology choices, and reduces flexibility in responding to buyer or regulator requests.

Early preparation allows companies to phase investments, pilot monitoring solutions, and build internal expertise gradually. It also reduces uncertainty. When reliable methane data is available, regulatory outcomes become easier to manage, regardless of whether timelines shift.

From a strategic perspective, readiness is not about assuming the strictest possible scenario. It is about ensuring that the company retains control over how it responds as rules evolve.

Conclusion

U.S. oil and gas exports still need to comply with the EU methane regulation. While political discussions may influence implementation details, they do not remove the underlying expectation that methane emissions associated with imported energy will be measured and disclosed.

For exporters, the key issue is not whether the rules will apply, but how prepared they are to meet them. Methane transparency is rapidly becoming a baseline requirement in global energy trade. Companies that invest early in credible measurement and reporting are better positioned to protect market access, manage risk, and navigate regulatory uncertainty with confidence.

As expectations around emissions data continue to rise, solutions that support accurate methane detection and robust carbon accounting will play an increasingly important role in helping the industry adapt. Preparation today is likely to be less costly, and more strategic, than reaction tomorrow.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.