- Article Summary

-

Overview

As the world accelerates its shift toward a low-carbon future, the demand for minerals essential to electric vehicles (EVs), solar panels, and wind turbines is skyrocketing. However, this surge in demand has also revived long-standing concerns around conflict minerals: resources that originate from areas of armed conflict and human rights abuses. Key materials such as cobalt, tantalum, tungsten, and tin (commonly referred to as 3TG) are critical for clean energy technologies but often sourced from high-risk regions like the Democratic Republic of Congo (DRC).

This article explores the intricate relationship between green technologies and conflict minerals, evaluates the current regulatory landscape in the US and EU, and offers actionable insights for businesses aiming to align decarbonization goals with responsible sourcing practices.

The Role of Critical Minerals in the Green Economy

The International Energy Agency (IEA) projects that the demand for critical minerals could increase fourfold by 2040 due to the energy transition. EV batteries require lithium, nickel, cobalt, manganese, and graphite. Wind turbines and solar panels rely on rare earth elements, copper, and tin. While these minerals are essential for the green transition, their extraction often involves significant ESG risks.

Human Rights Violations: Artisanal and small-scale mining (ASM) in regions like the DRC is frequently linked to child labor, exploitative labor practices, and hazardous working conditions that pose severe health and safety risks to miners. Many miners operate without protective equipment or formal oversight, making injuries and fatalities alarmingly common.

Environmental Degradation: Mining operations, particularly in unregulated contexts, can cause widespread deforestation, soil erosion, and contamination of water sources with heavy metals and chemicals such as mercury. These impacts degrade biodiversity, disrupt ecosystems, and threaten the livelihoods of local communities who depend on natural resources.

Corruption and Armed Conflict: In politically unstable regions, mineral wealth can be captured by armed groups who use the proceeds to fund violent activities. This entrenches cycles of conflict, weakens governance, and undermines peace-building efforts. The illicit trade of conflict minerals often involves bribery and opaque supply chains, making accountability and traceability difficult.

Current Regulatory Frameworks: US and EU Approaches

The global response to conflict minerals has evolved, particularly with legislative efforts in the United States and the European Union.

United States – Dodd-Frank Act, Section 1502: This requires publicly listed companies to disclose their use of 3TG minerals and conduct due diligence on their supply chains. However, enforcement has been inconsistent, and critics argue the rule lacks the teeth to ensure meaningful change.

European Union – Conflict Minerals Regulation (Effective 2021): This regulation applies to importers of 3TG minerals into the EU and mandates supply chain due diligence aligned with OECD guidelines. While comprehensive, its scope is currently limited to upstream companies.

Corporate Sustainability Due Diligence Directive (CSDDD): Scheduled for implementation in 2026, CSDDD will impose broader human rights and environmental due diligence requirements on large companies operating in the EU market, potentially covering the full supply chain of conflict minerals.

The ESG Risk Nexus: Balancing Decarbonization and Ethics

Corporations face increasing pressure from investors, regulators, and consumers to decarbonize operations and products. However, if ESG due diligence is not embedded into mineral sourcing strategies, these green efforts may unintentionally support exploitative practices.

Notable tensions include EV supply chains, where cobalt used in lithium-ion batteries is predominantly mined in the DRC. While cobalt is indispensable for high energy density and battery life, its mining often involves child labor, unregulated artisanal operations, and severe health and safety risks. Companies like Tesla and BMW have faced scrutiny over their sourcing practices, leading some to invest in direct partnerships with verified mines or to explore cobalt-free battery alternatives.

Similarly, solar panel manufacturing relies on polysilicon and tin, materials linked to reports of forced labor and opaque sourcing practices in regions such as Xinjiang and Southeast Asia. Despite the promise of clean energy, the upstream labor and human rights issues present reputational risks that could undermine the ethical narrative of the green transition.

As global demand continues to rise, these ethical dilemmas will only intensify, requiring companies to integrate human rights considerations as foundational elements of their sustainability strategies.

Mitigation Strategies and Corporate Best Practices

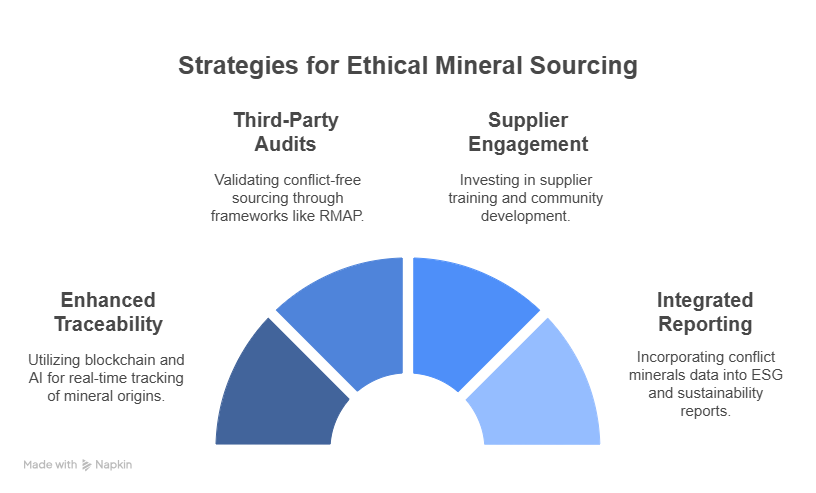

To navigate these complexities, leading firms are adopting proactive risk management approaches:

- Enhanced Traceability: Technologies like blockchain and AI are enabling real-time tracking of mineral provenance.

- Third-Party Audits and Certifications: Frameworks such as the Responsible Minerals Assurance Process (RMAP) help validate conflict-free sourcing.

- Supplier Engagement and Capacity Building: Investing in supplier training and local community development ensures more resilient, ethical supply chains.

- Integrated Reporting: Incorporating conflict minerals data into ESG disclosures and sustainability reports enhances transparency and accountability.

Companies like Apple and Intel have set industry benchmarks by publishing detailed conflict minerals reports and sourcing policies.

Conclusion

As green technologies continue to scale, the hidden dilemma of conflict minerals poses a reputational and operational risk that companies can no longer afford to ignore. Striking the right balance between climate ambition and ethical sourcing is not just a regulatory imperative, it’s a moral one.

Forward-looking companies will recognize that sustainable decarbonization must include social responsibility at every stage of the supply chain. By integrating conflict mineral due diligence into ESG strategy, businesses can build trust, enhance resilience, and contribute to a truly just energy transition.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.