- Article Summary

-

As environmental, social, and governance (ESG) considerations become increasingly central to corporate strategy, the Carbon Disclosure Project (CDP) continues to refine its evaluation criteria to promote transparency and accountability. The 2025 CDP cycle introduces several critical updates that companies must understand to enhance their environmental disclosures and improve their scores.

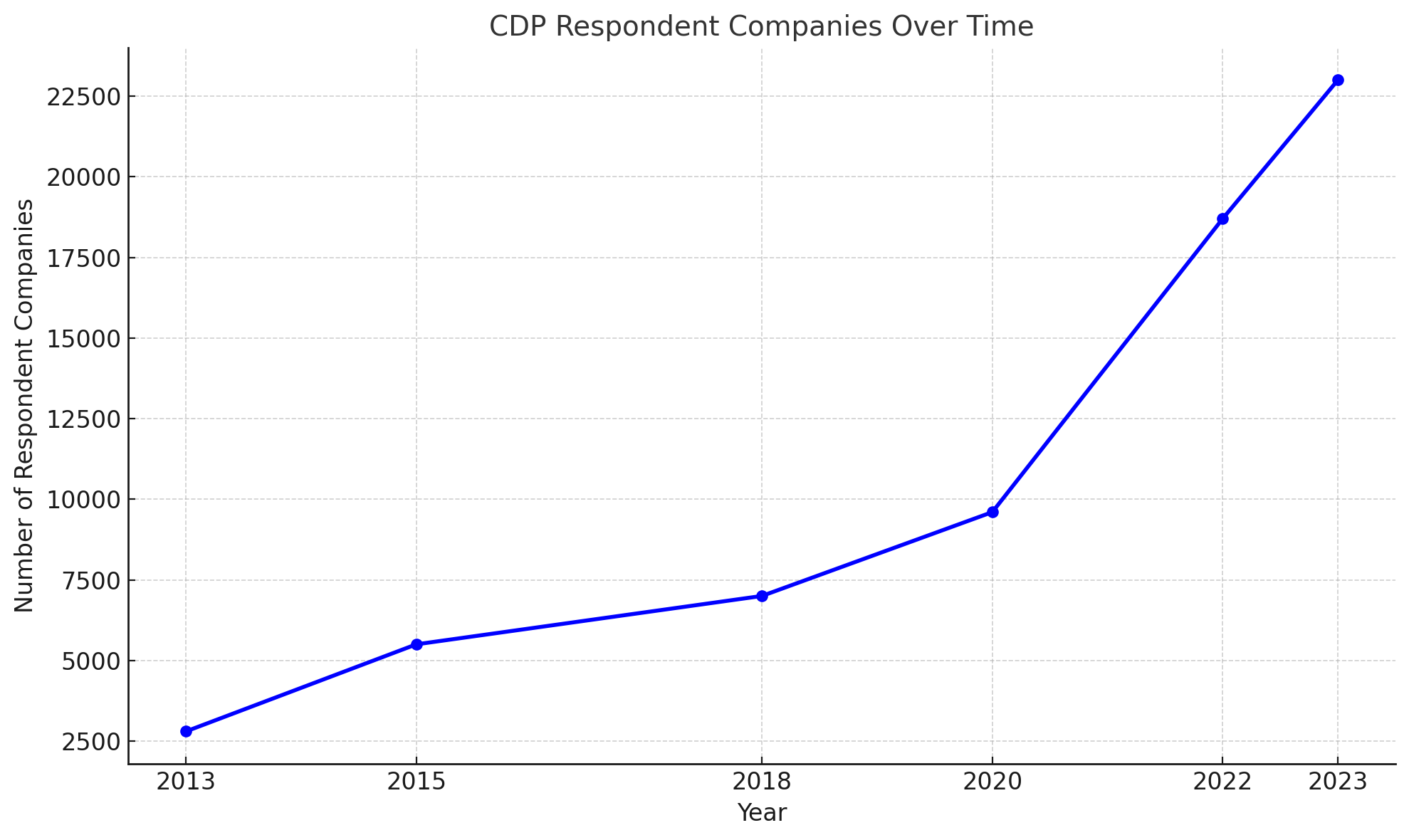

CDP Reporting Trends and Participation Growth

One of the clearest indicators of CDP’s growing influence is the consistent rise in the number of companies participating in its disclosure system. The following chart illustrates the upward trend in CDP respondent companies over the past decade:

(Source: CDP 2023 Global Environmental Disclosure Report)

Key Changes in CDP 2025 Scoring Criteria

CDP has emphasized that the 2025 disclosure cycle will maintain structural stability while introducing meaningful refinements aimed at increasing the robustness and comparability of environmental data. Here are the most significant updates:

1. Changes in the Response System

In addition to adjustments in integrated questions, the range of responses required has expanded. This means that companies must prepare for deeper and broader disclosures, covering a more comprehensive scope of operations and risks.

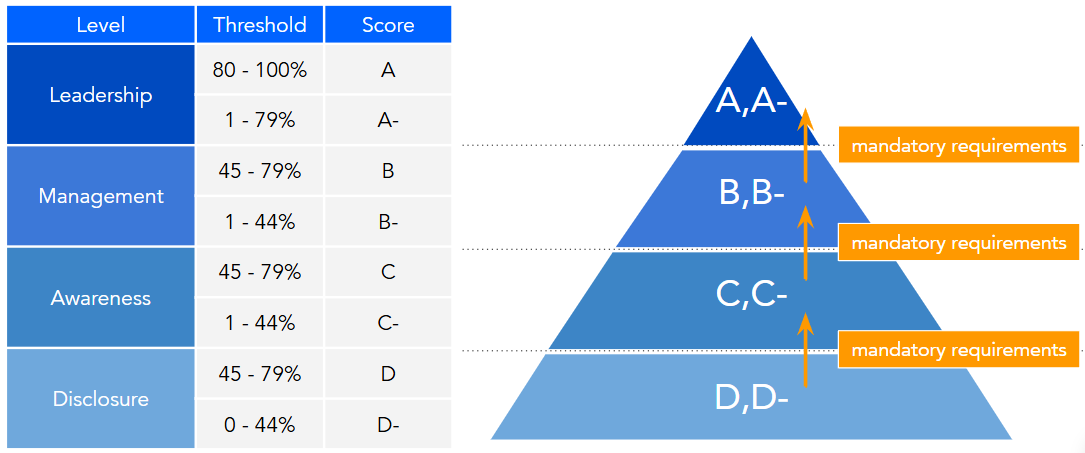

2. Mandatory Requirements

A substantial shift for 2025 is the extension of mandatory requirements. Previously applicable only to A-list companies, key requirements such as target-setting and governance disclosures now apply to all companies with a C score or higher. This change is expected to significantly raise the bar for mid-performing entities.

3. Changes in Questionnaire Content

The updated questionnaire includes new response items added to existing questions. Notably, elements of the Taskforce on Nature-related Financial Disclosures (TNFD) have been introduced, urging companies to consider biodiversity and nature-related risks as part of their climate strategy.

4. Verification and Assurance Enhancements

CDP now requires:

- 100% third-party verification of Scope 1 and 2 emissions

- At least 70% third-party verification of Scope 3 emissions

This represents a new baseline for credible and trustworthy emissions reporting.

5. Science-Based and Transparent Targets

Companies must set short-term targets validated by the Science Based Targets initiative (SBTi) or equivalent and ensure all disclosures are made public to qualify for top scores.

Strategic Actions to Elevate Your CDP Score

So, how can companies respond effectively to these changes? Below are several proven strategies, along with real-world examples of companies that have improved their CDP ratings:

- Invest in Emissions Verification

Example: A leading Japanese electronics company improved from B to A- after implementing third-party verification for 100% of Scope 1 and 2 and 80% of Scope 3 emissions. - Develop Climate Transition Plans

Ensure alignment with the 1.5°C scenario and clearly communicate timelines, accountability structures, and financial implications. - Set and Publish Science-Based Targets

Companies with approved SBTi targets are more likely to reach A-level scores. - Public Disclosure

Organizations that made their responses public saw an average improvement of one full score tier within two years. - Integrate TNFD and Nature Risk Management

Start identifying key ecosystem dependencies and threats, even if your industry is not nature-intensive.

Your CDP 2025 Questions Answered

Wondering how to elevate your CDP score?

We’ll share practical strategies and real-world examples of companies that have successfully improved their ratings!

Confused about how CDP connects with other sustainability frameworks?

We’ll clarify the common ground and efficient approaches when considering ESRS, IFRS S2, and TNFD for your 2025 reporting.

Unsure about the difference between verification and assurance for CDP 2025?

We’ll break down the essentials you need to know for accurate and credible submissions.

Conclusion

While the 2025 CDP cycle is framed as a year of relative stability, the added requirements and broadened expectations represent a clear elevation in what qualifies as environmental leadership. Companies that act early to enhance their governance, verification, and target-setting mechanisms will not only improve their CDP scores but also reinforce investor confidence and market credibility.

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification. Notably, Asuene boasts over 400 successful CDP support cases, consistently maintaining or improving client scores by over 90% through its expert consulting and software solutions.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.