- Article Summary

-

Overview

As global climate goals intensify, the pressure to deploy technologies that can reduce or neutralize carbon emissions is mounting. Two dominant approaches have emerged: Carbon Capture, Utilization and Storage (CCUS) and Carbon Removal. While often grouped under the umbrella of carbon management, these strategies are fundamentally distinct in terms of mechanisms, maturity, and long-term climate impact. This article aims to clarify those differences, offering insights for policymakers, investors, and sustainability officers navigating the evolving decarbonization landscape.

Defining the Frameworks: CCUS vs. Carbon Removal

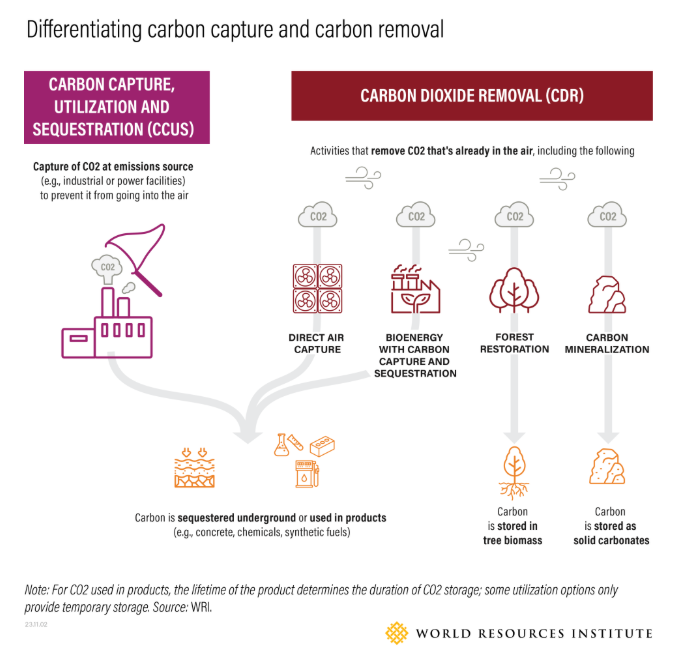

CCUS involves capturing CO2 emissions at the point of generation, typically from power plants or industrial facilities, and either utilizing the gas in products or storing it underground. It is an emissions avoidance strategy.

Carbon Removal, on the other hand, refers to extracting CO2 directly from the atmosphere. This includes technological solutions like Direct Air Capture (DAC) and nature-based methods such as afforestation and soil carbon sequestration. It is an emissions reversal strategy.

The fundamental difference lies in the point of intervention: CCUS prevents future emissions, while Carbon Removal targets past emissions.

Deployment Landscape and Policy Incentives

In the United States, the Inflation Reduction Act (IRA) has introduced robust tax credits for both CCUS and Carbon Removal, with Section 45Q providing up to $85 per ton for industrial CCUS and up to $180 per ton for DAC. These incentives have catalyzed significant private sector interest and investment, particularly in retrofitting existing industrial assets and funding pilot-scale removal initiatives.

Meanwhile, the European Union, under its 2025 Industrial Carbon Management Strategy, places a stronger policy emphasis on permanent removals with standardized monitoring and reporting requirements. The EU also promotes cross-border CO2 transport infrastructure and is working toward harmonized certification systems for carbon removals through its Carbon Removal Certification Framework (CRCF).

Despite policy support, CCUS is generally more mature and commercially deployed. As of 2025, over 40 large-scale CCUS facilities are operational globally, including integrated projects in North America, the Middle East, and China. These focus on sectors such as cement, steel, and hydrogen production, where emissions are otherwise challenging to abate.

Carbon Removal projects, by contrast, are still largely in pilot or early deployment stages, particularly in the Global North. Direct Air Capture (DAC) hubs are emerging in the U.S., Canada, and parts of Europe, often co-located with geological storage sites. Nature-based solutions continue to be more broadly distributed but face increased scrutiny around permanence, additionality, and measurement.

Looking ahead, policy clarity and long-term signals such as carbon pricing mechanisms, procurement mandates, and public-private partnerships will be crucial to scaling both CCUS and Carbon Removal. Global coordination will also be vital, as cross-border infrastructure and credit recognition become more central to market development.

Economic and Technical Considerations

| Factor | CCUS | Carbon Removal |

|---|---|---|

| Average Cost (2025 est.) | $60-120/ton | $150-600/ton |

| TRL (Tech Readiness Level) | 8-9 | 4-7 |

| Storage Durability | High | Varies by method |

| Infrastructure Needs | High (pipelines, storage) | Moderate to high |

CCUS is often more cost-effective in high-concentration CO2 streams, while Carbon Removal is essential for addressing diffuse emissions (Scope 3). However, Carbon Removal methods like DAC offer more durable storage when paired with geological sequestration.

Strategic Priorities and Business Integration

For policymakers, understanding the distinction between CCUS and Carbon Removal is essential for crafting effective climate strategies. CCUS offers a practical pathway to decarbonize hard-to-abate sectors such as steel, cement, and petrochemicals. In contrast, Carbon Removal plays a central role in achieving net-negative emissions, which are critical to long-term climate stabilization.

For investors, CCUS offers nearer-term returns given its higher technological maturity and lower current costs. Carbon Removal, though still in early stages, presents alignment with evolving ESG frameworks and emerging voluntary carbon markets.

A balanced climate portfolio will likely require a dual-track approach. Countries with significant industrial emissions may prioritize CCUS throughout the 2020s, while simultaneously laying the groundwork for scaling Carbon Removal into the 2030s and beyond to meet net-zero and net-negative goals.

From a business perspective, CCUS should be viewed as a vital but limited tool within a broader decarbonization strategy. Its effective use hinges on robust policy and financial support, which remains insufficient in many jurisdictions. Moreover, responsible deployment demands clear regulatory oversight and meaningful community engagement to uphold environmental and social integrity.

Crucially, CCUS must not be perceived as a license to continue fossil fuel dependence. Businesses should adopt it as a complementary solution alongside renewable energy, efficiency improvements, and emissions reduction measures to construct resilient and future-ready sustainability strategies.

Conclusion

Understanding the distinction between CCUS and Carbon Removal is not just semantic—it is strategic. The two serve different purposes on the carbon curve, and both will play critical roles in achieving climate targets. By recognizing their differences and complementarities, global climate leaders can craft nuanced, effective pathways toward decarbonization and climate resilience.

As businesses adopt these technologies, they must remain aware of the broader context: CCUS is one piece of a complex puzzle. It must be deployed responsibly, transparently, and alongside aggressive emissions reduction efforts to ensure a just and sustainable climate transition.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.