- Article Summary

-

Introduction

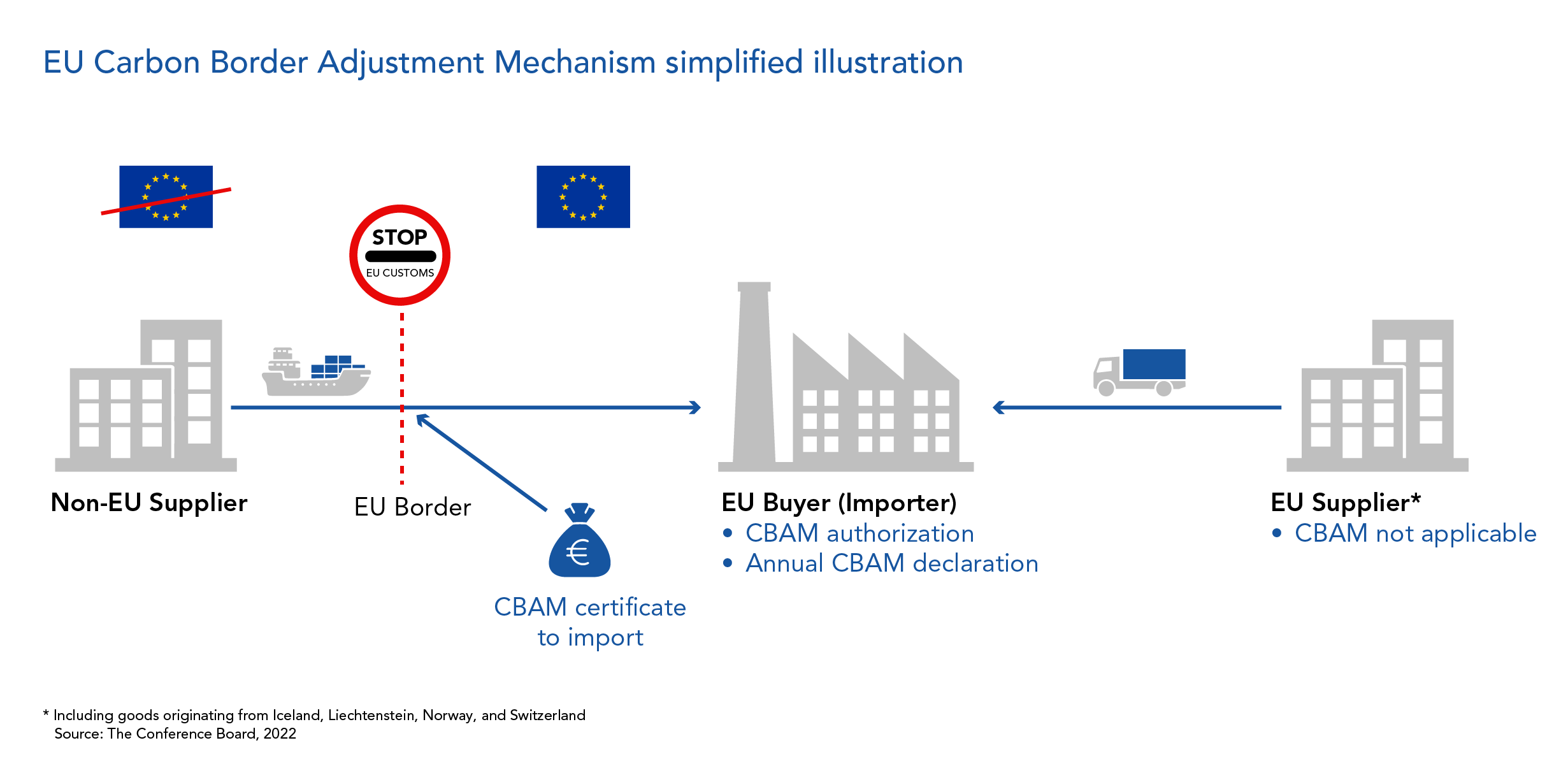

The Carbon Border Adjustment Mechanism (CBAM) is a key component of the European Union’s climate policy framework under the European Green Deal. It is designed to ensure that the carbon costs borne by EU producers are mirrored by importers of carbon-intensive goods, thereby addressing the risk of carbon leakage and encouraging global decarbonization efforts.

CBAM will gradually require importers to pay for the embedded emissions in their goods through the purchase of CBAM certificates, in line with the price of EU Emissions Trading System (EU ETS) allowances. The regulation entered into force in October 2023, with a transitional reporting phase followed by a definitive phase starting in 2026.

This article provides a structured overview of CBAM tailored to ESG professionals, focusing on its timeline, scope, compliance requirements, and enforcement mechanisms. The content is divided into two perspectives: EU-based companies and non-EU exporters.

1. CBAM Overview and Objectives

- Prevent carbon leakage by imposing a carbon price on certain imports equivalent to that faced by EU producers.

- Ensure fair competition between EU and non-EU producers by aligning carbon costs.

- Incentivize cleaner production practices globally.

- Support the EU’s commitment to achieving climate neutrality by 2050.

2. CBAM for EU-Based Companies

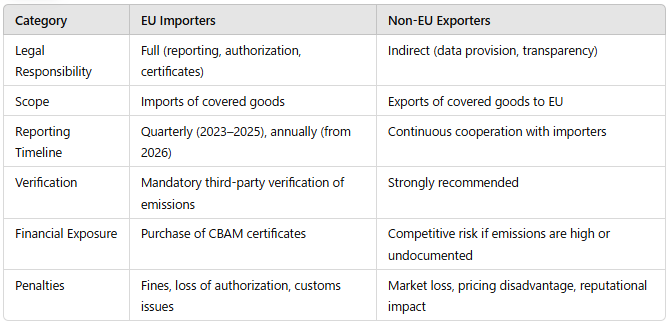

The CBAM imposes direct compliance obligations on companies located within the European Union, specifically those that import carbon-intensive goods from outside the EU. While domestic producers are not subject to CBAM directly, they are impacted by the gradual phase-out of free EU ETS allowances, which CBAM is designed to complement.

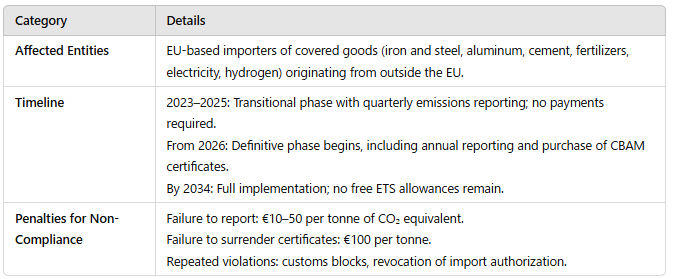

2.1 Overview: Applicability, Timeline, and Penalties

2.2 Compliance Requirements for EU Importers

In order to fulfill CBAM obligations, EU importers should take the following actions:

- Authorization: Obtain status as an “Authorized CBAM Declarant” by the end of 2025 in order to continue importing covered goods from 2026 onwards.

- Transitional Reporting (2023–2025): Submit quarterly reports detailing the quantity of imported goods, embedded direct and indirect emissions, and any carbon price paid in the country of origin. Reports must be accurate and submitted via the EU CBAM registry.

- Definitive Phase Obligations (From 2026):

- Submit an annual verified emissions report by 31 May of the following year.

- Purchase and surrender CBAM certificates equivalent to the verified emissions embedded in imported goods.

- Maintain documentation and verification records to support reported data.

- Deduct foreign carbon prices where applicable, provided sufficient evidence is presented.

To meet these obligations effectively, ESG and compliance officers should coordinate with procurement, legal, and operational teams to establish internal processes for emissions tracking, reporting, and certificate management.

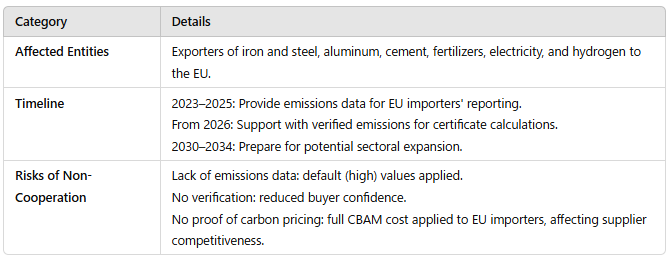

3. CBAM for Non-EU Exporters

While the legal obligations under CBAM fall primarily on EU-based importers, exporters located outside the European Union are expected to provide critical emissions-related data. Their level of cooperation will significantly influence their continued access to and competitiveness in the EU market.

3.1 Overview: Applicability, Timeline, and Risks

3.2 Recommended Actions for Exporters

To ensure continued market access and to maintain a competitive edge in the European Union, exporters are strongly advised to take the following actions:

- Establish reliable emissions monitoring systems based on methodologies aligned with EU expectations.

- Obtain third-party verification of emissions data to enhance credibility and avoid default value penalties.

- Document any carbon costs paid domestically, enabling EU importers to deduct them from CBAM obligations.

- Proactively engage with EU trading partners to ensure alignment on data-sharing procedures and timelines.

- Develop internal CBAM awareness within compliance, sustainability, and operations teams to ensure cross-functional readiness.

Taking these steps not only supports compliance but also signals to EU partners that the exporter is a reliable and responsible supplier within a carbon-conscious global market.

4. Summary Table: EU and Non-EU Obligations Compared

5.Latest Developments

As of early 2025, the implementation of the CBAM transitional phase is well underway. Importers have now completed multiple rounds of quarterly emissions reporting via the EU CBAM Transitional Registry. While the European Commission has issued detailed technical guidance to support reporting accuracy, several operational challenges have been reported by both EU importers and non-EU exporters, particularly in obtaining verified emissions data from complex supply chains.

In response to stakeholder feedback, the European Commission is currently evaluating options to simplify administrative burdens ahead of the definitive phase in 2026. Among the measures under consideration are:

- The introduction of a de minimis threshold that would exempt import consignments below a certain weight (e.g., 50 tonnes) from CBAM reporting obligations.

- Streamlining the process for calculating and verifying emissions by allowing the continued use of certain default values under specific conditions.

- Enhancing interoperability between the CBAM reporting portal and existing customs platforms.

While these adjustments aim to improve implementation efficiency, they do not alter the fundamental structure or objectives of CBAM.

6.Future Outlook

Looking ahead, several important developments are expected that will influence both the scope and operational dynamics of CBAM:

- Expansion of CBAM Scope (Post-2026 Review)

By the end of 2025, the European Commission is required to assess the possibility of extending CBAM to additional sectors, such as chemicals, plastics, and organic basic materials. Companies operating in adjacent industries should begin evaluating their carbon exposure in anticipation of a potential inclusion. - Phase-Out of Free EU ETS Allowances (2026–2034)

As CBAM is fully phased in, free emissions allowances for EU-based producers in covered sectors will gradually be eliminated. By 2034, these producers will bear the full carbon cost under the EU ETS, reinforcing the alignment between domestic and imported goods. - Emergence of International Carbon Pricing Mechanisms

Several non-EU countries are considering or implementing domestic carbon pricing frameworks in response to CBAM. Over time, this may lead to increased global harmonization of carbon pricing and could affect the deductibility of foreign carbon costs under CBAM. - Potential Trade Disputes and WTO Oversight

While the EU has emphasized CBAM’s compatibility with WTO rules, ongoing diplomatic dialogues and legal assessments are likely, particularly with major trading partners. ESG professionals should monitor international trade developments that may affect CBAM enforcement or lead to adjustments in its design. - Integration into Corporate Climate Strategies

Beyond compliance, CBAM is expected to become a permanent fixture in climate-aligned trade. It will increasingly be integrated into supply chain risk assessments, product carbon footprint management, and ESG reporting practices.

Given the evolving regulatory landscape, ESG professionals are advised to:

Align CBAM compliance strategies with broader climate goals, including Scope 3 emissions management and science-based targets.

Maintain regular monitoring of CBAM-related legislative updates and technical guidance from the European Commission.

Incorporate CBAM exposure into enterprise risk assessments, especially for import-heavy operations.

Engage upstream suppliers early to foster transparency and facilitate long-term compliance.

Invest in digital systems that enable emissions data integration, verification, and audit-readiness across the supply chain.

Why Work with Asuene?

Navigating carbon regulations and accelerating corporate decarbonization requires more than just visibility—it demands a comprehensive and actionable approach. Asuene supports companies across this journey with an integrated solution set. Asuene can provide software and consulting support for CFP calculation, which is necessary for CBAM.

Download Our Expert Publications