- Article Summary

-

Overview

Carbon pricing is a critical tool in the global effort to reduce greenhouse gas emissions. By assigning a monetary value to carbon emissions, it incentivizes businesses and consumers to reduce their carbon footprints. This approach ensures that the societal costs of carbon emissions—such as health impacts, environmental damage, and economic disruption—are reflected in economic decisions.

There are two primary mechanisms:

- Carbon Tax: A fixed price per ton of CO₂ emitted, providing price certainty but with uncertain emission reductions.

- Emissions Trading System (ETS): A market-based approach where a cap on total emissions is set, and companies trade emission allowances. This provides certainty in emission reductions but with variable pricing.

These mechanisms help internalize the environmental cost of emissions, promoting cleaner technologies and practices. For companies, carbon pricing creates both a financial risk and an opportunity to lead in climate-responsible innovation.

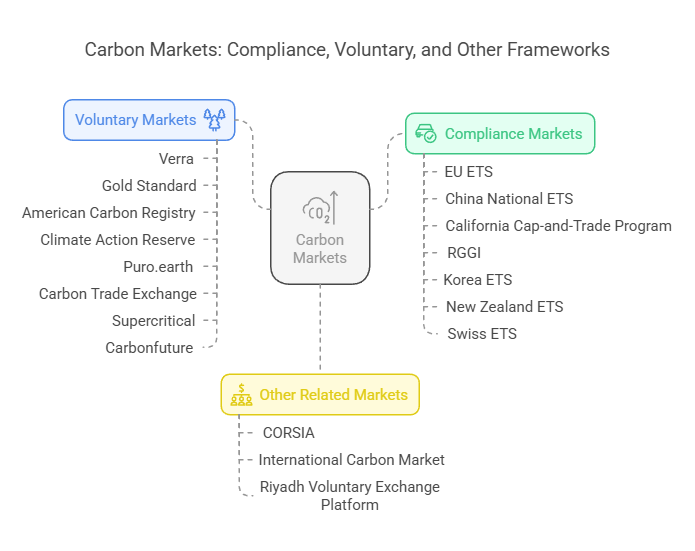

Major Carbon Markets

Voluntary Markets

- Overview: Markets where companies or individuals voluntarily participate to purchase and offset carbon credits. Privately led, centered on project-based credits.

- Characteristics: Voluntary participation, high flexibility, and support for emission reductions outside regulated sectors.

- Remarks (Specific Program/Market Names):

- Verra (Verified Carbon Standard: VCS): A leader in the voluntary market, certifying forest protection and renewable energy projects.

- Gold Standard: Provides high-quality credits with an emphasis on sustainable development.

- American Carbon Registry (ACR): The first U.S. voluntary offset program, handling diverse projects.

- Climate Action Reserve (CAR): North America-focused, certifying forest management and waste reduction credits.

- Puro.earth: Specializes in carbon removal (CDR), supporting biochar and direct air capture (DAC).

- Carbon Trade Exchange (CTX): A global spot exchange handling various credits.

- Supercritical: Offers carbon removal credits tailored for the tech sector.

- Carbonfuture: An emerging platform focused on high-quality carbon removal.

Compliance Markets

- Overview: Markets established by governments or international organizations with a legal framework, mandating companies to reduce emissions or participate in trading. The cap-and-trade system is predominant, with prices determined by market supply and demand.

- Characteristics: Mandatory participation, large-scale, and a cornerstone of climate policy.

- Remarks (Specific Market Names):

- EU ETS (European Union Emissions Trading System): The world’s largest ETS, covering power, industry, and aviation sectors. Approximately 100 EUR/ton as of 2023.

- China National ETS: Focused on the power sector with plans for future expansion, targeting around 4 billion tons of CO2.

- California Cap-and-Trade Program: A collaboration between California and Quebec, regulating power and manufacturing sectors.

- Regional Greenhouse Gas Initiative (RGGI): An ETS for the power sector across 11 eastern U.S. states.

- Korea ETS: Asia’s first nationwide ETS, covering about 70% of emissions.

- New Zealand ETS (NZ ETS): A unique system including agriculture and forestry.

- Swiss ETS: A small-scale market linked to the EU ETS.

Other Related Markets

- Overview: Markets positioned between compliance and voluntary frameworks or based on specific industries or international agreements.

- Remarks (Specific Market Names):

- CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation): An offset program for the aviation industry, set to become mandatory from 2027.

- International Carbon Market under Article 6 of the Paris Agreement: Regulates emissions trading between nations (ITMOs), currently in preparation.

- Riyadh Voluntary Exchange Platform: A Saudi Arabia-led voluntary market for the Middle East region.

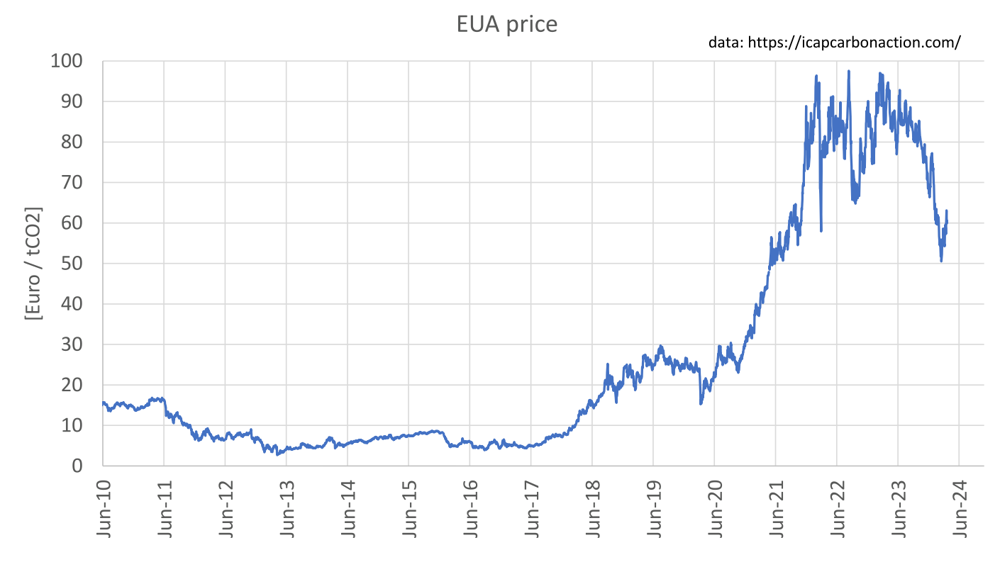

Historical Carbon Price Trends

Carbon prices have shown significant volatility over the past two decades, influenced by economic events, policy adjustments, and regulatory reforms. Below is a graph illustrating the EU ETS carbon price trends, followed by an explanation of key shifts.

Source: Ember, European Energy Exchange (EEX)

Notable Developments:

- 2007–2013: The first two phases of EU ETS saw price crashes due to excessive allocation of free allowances and economic downturns. This highlighted the importance of market design in cap-and-trade systems.

- 2018: Introduction of the Market Stability Reserve helped remove surplus allowances, restoring confidence and steadily increasing prices.

- 2021–2023: Policy ambition combined with external shocks (e.g., war in Ukraine) led to record-high prices above €100/ton.

- 2024: Prices fell as the EU released additional allowances under the REPowerEU plan and energy demand dropped due to a mild winter.

| Year | Key Event | EU Carbon Price (€/ton) |

|---|---|---|

| 2005 | EU ETS launched | ~€7 |

| 2007 | Oversupply crash due to over-allocation | ~€0 |

| 2008 | Financial crisis reduces industrial output | ~€30 → €10 |

| 2013 | Persistent market surplus keeps prices low | ~€5 |

| 2018 | Market Stability Reserve introduced | ~€20 |

| 2021 | EU “Fit for 55” policy proposal | ~€50 |

| 2023 | Record high amid energy crisis and tightened cap | >€100 |

| 2024 | Market correction due to mild winter and policy-driven auction | ~€60 |

Despite fluctuations, the long-term trend reflects increasing carbon costs aligned with tightening climate policies.

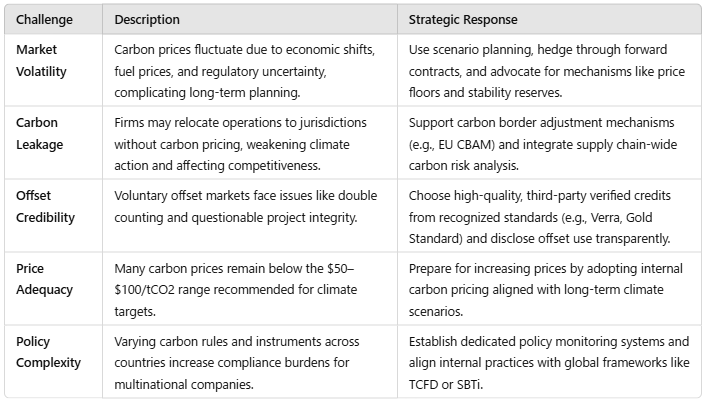

Challenges and Strategic Responses in Carbon Pricing

Carbon pricing systems are expanding globally, but their effectiveness and stability still face notable obstacles. For companies, identifying key challenges and formulating strategic responses is essential to mitigate risks and unlock opportunities in the transition to a low-carbon economy.

Strategic Actions Companies Should Consider

- Monitor Policy and Compliance

Track carbon pricing developments across operating jurisdictions, including emerging schemes like China’s ETS and EU CBAM. - Improve Emissions Data

Implement robust GHG accounting across Scope 1–3 using automated platforms and third-party verification. - Reduce Emissions

Focus on cost-effective reductions through energy efficiency, renewable procurement, and electrification. - Manage Carbon Market Exposure

Create strategies for compliance (e.g., ETS trading) and voluntary offsets. Use high-quality credits aligned with climate goals. - Adopt Internal Carbon Pricing

Apply shadow pricing or internal fees to steer investments and anticipate future carbon costs. - Align with Climate Goals

Integrate carbon pricing into decarbonization roadmaps, disclose under TCFD, and align with SBTi or net-zero pledges.

By addressing these challenges proactively, companies can not only ensure compliance but also position themselves as resilient and forward-looking actors in a carbon-constrained world.

Future Outlook and Preparation

The global momentum behind carbon pricing is only expected to accelerate. As governments raise their climate ambitions, more countries will implement or strengthen carbon pricing mechanisms. Prices are likely to rise—both to meet emissions targets and to reflect the true cost of carbon. Additionally, emerging frameworks under the Paris Agreement, such as Article 6, will promote international collaboration and potentially connect carbon markets across borders.

Technological advancements, increased scrutiny on climate claims, and evolving stakeholder expectations will further push companies to manage their carbon exposure with rigor. Voluntary markets will continue maturing, with an emphasis on transparency, integrity, and co-benefits.

To prepare, companies should:

- Scenario-plan for a high-carbon-price world, integrating $100+/tCO₂ assumptions into long-term strategies.

- Embed carbon considerations across all business functions, from procurement and product design to investor relations.

- Invest in resilience, including emissions reduction technologies, supplier engagement, and climate-aligned innovation.

- Stay ahead of regulation, by not only complying but actively shaping policy through industry engagement.

Ultimately, carbon pricing is not just a policy mechanism—it’s a strategic lens. Organizations that embrace it today will be best positioned to thrive in the low-carbon economy of tomorrow.

Why Work with Asuene?

Navigating carbon regulations and accelerating corporate decarbonization requires more than just visibility—it demands a comprehensive and actionable approach. Asuene supports companies across this journey with an integrated solution set.

We don’t just offer carbon accounting software and consulting to visualize and manage GHG emissions across Scope 1, 2, and 3. We also operate Carbon EX, a carbon credit exchange platform that enables companies to procure high-quality credits and participate in emissions trading. This end-to-end support helps organizations comply with regulations, enhance transparency, and make tangible progress toward net-zero goals.

From emission tracking and strategy development to market transactions, Asuene empowers businesses to take climate action with confidence.

Download Our Expert Publications