- Article Summary

-

Tracking a corporate carbon footprint has evolved from a voluntary sustainability initiative to a strategic imperative. In an era defined by climate risks, stakeholder pressure, and increasingly stringent regulations, understanding and managing carbon emissions is foundational to corporate resilience. Yet, beyond compliance and public reporting, carbon footprinting is emerging as a powerful tool for business intelligence.

This article explores how leading companies are moving beyond annual GHG inventories and embedding carbon data into strategic decisions across product design, procurement, finance, and innovation. By leveraging carbon metrics as a driver of performance and transparency, businesses are gaining a competitive edge while preparing for the demands of a net-zero economy.

Carbon Footprint Fundamentals: Scope 1, 2, and 3 Explained

A comprehensive carbon footprint includes emissions across three scopes as defined by the Greenhouse Gas Protocol:

- Scope 1: Direct emissions from company-owned operations (e.g., combustion, fleet).

- Scope 2: Indirect emissions from purchased energy (e.g., electricity, heating).

- Scope 3: All other indirect emissions in the value chain (e.g., suppliers, business travel, product use).

While Scope 1 and 2 are easier to quantify and reduce, Scope 3 often constitutes over 70% of total emissions, making it critical for companies with complex supply chains.

Table: Typical Emission Breakdown by Industry (illustrative)

| Industry | Scope 1 (%) | Scope 2 (%) | Scope 3 (%) |

|---|---|---|---|

| Apparel | 5 | 10 | 85 |

| Automotive | 15 | 20 | 65 |

| Software/IT | 3 | 12 | 85 |

| Consumer Goods | 10 | 15 | 75 |

Understanding these categories is the first step toward actionable carbon intelligence. Measurement tools, such as life cycle assessment (LCA) software and emissions databases, are increasingly used to attribute carbon data to specific products, regions, or processes.

From Compliance to Strategy: Embedding Carbon into Core Decisions

Companies that treat carbon footprinting as more than a compliance box are unlocking significant strategic value. Carbon data can inform decisions in:

- Product development: Low-carbon design through material selection and modularity.

- Procurement: Supplier evaluation based on emissions intensity.

- Finance: Internal carbon pricing to prioritize investments.

- Logistics: Route optimization and low-carbon transportation modes.

For example, Unilever integrates Scope 3 emissions into its product innovation pipeline to design formulations with lower environmental impact. Siemens uses carbon data in its digital twin models to simulate energy use in factories.

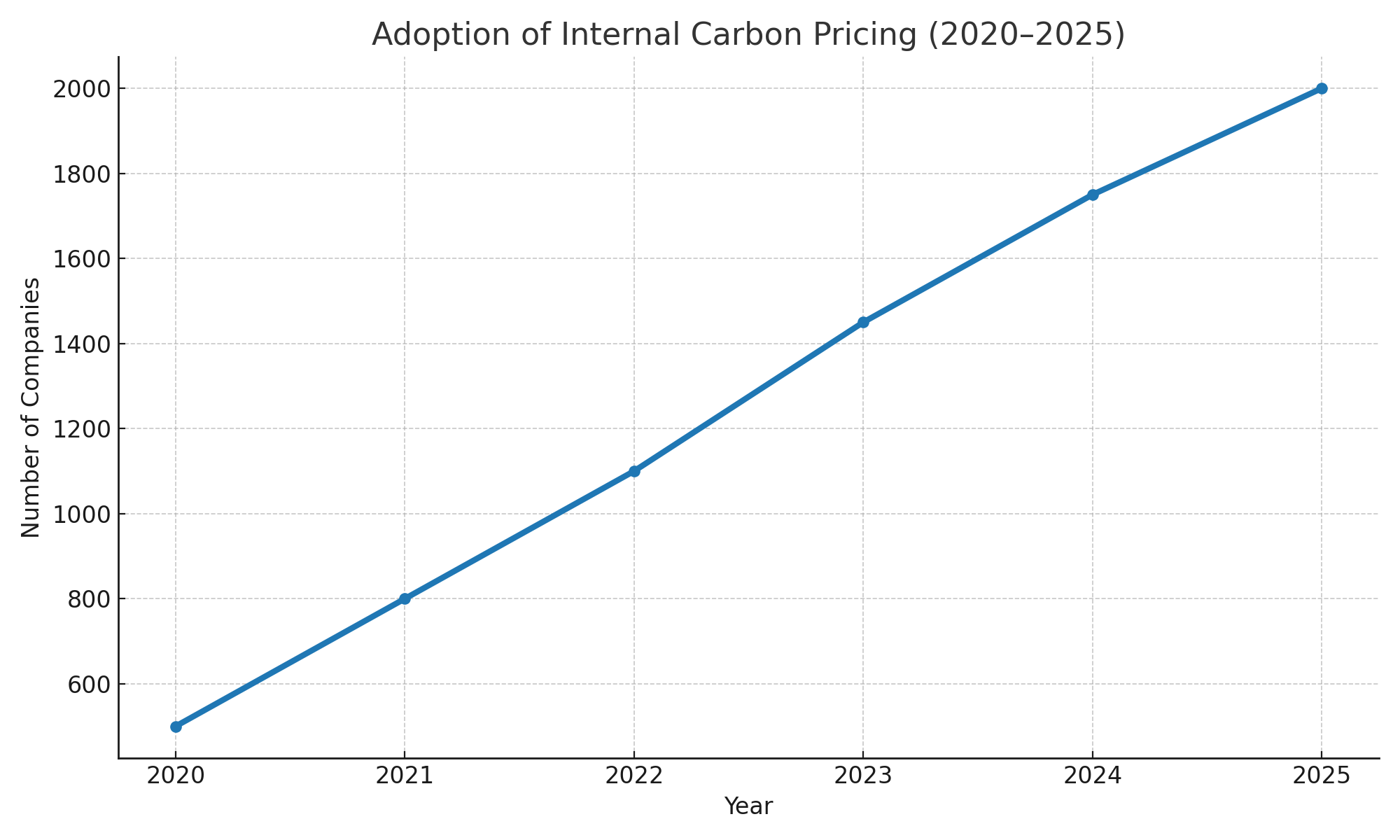

Internal Carbon Pricing Adoption (2020–2025, projected)

Embedding carbon into decisions also prepares companies for future carbon costs. As more jurisdictions implement emissions trading systems (EU ETS, CBAM) or carbon taxes, internalizing these prices today mitigates long-term financial risk.

Digitalization and Carbon Accounting Tools

The rise of carbon intelligence has been enabled by a new generation of digital tools:

- GHG accounting platforms (e.g., Normative, Greenly, Persefoni) automate data collection.

- LCA software (e.g., SimaPro, OpenLCA) models product-level impacts.

- Supplier data hubs enable emissions tracking across value chains.

These systems reduce manual effort, increase granularity, and align with frameworks like CDP, SBTi, and CSRD. Many tools now incorporate AI to identify emission hotspots, simulate scenarios, and recommend reduction strategies.

Table: Key Carbon Accounting Tools and Use Cases

| Tool | Function | Best For |

| Normative | Corporate carbon accounting | SMEs and mid-sized companies |

| SimaPro | Product LCA modeling | Eco-design, R&D |

| CDP Platform | Disclosure and benchmarking | ESG reporting and investor use |

Organizational Benefits: From Risk to Reputation

Tracking and managing carbon footprints drives multiple business benefits:

- Risk mitigation: Anticipate carbon pricing and supply chain disruptions.

- Investor confidence: Meet climate disclosure expectations (e.g., ISSB, TCFD).

- Customer loyalty: Communicate product-level emissions transparently.

- Innovation: Unlock efficiencies through redesign and digital optimization.

Moreover, carbon intelligence is increasingly required for B2B procurement. Major buyers like Microsoft, IKEA, and Walmart now require suppliers to disclose emissions and set reduction targets. Companies without such data risk being excluded from future value chains.

Conclusion

Carbon footprinting is no longer just a sustainability reporting task—it is a lens through which future-ready businesses view performance, resilience, and innovation. By embedding carbon intelligence across operations and governance, companies can lead the transition to a low-carbon economy while building stakeholder trust. In doing so, they are not just counting carbon—they are using it to count what truly matters for long-term value.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.