- Article Summary

-

Introduction: The Uncertain Future of Canada’s Oil & Gas Emissions Cap

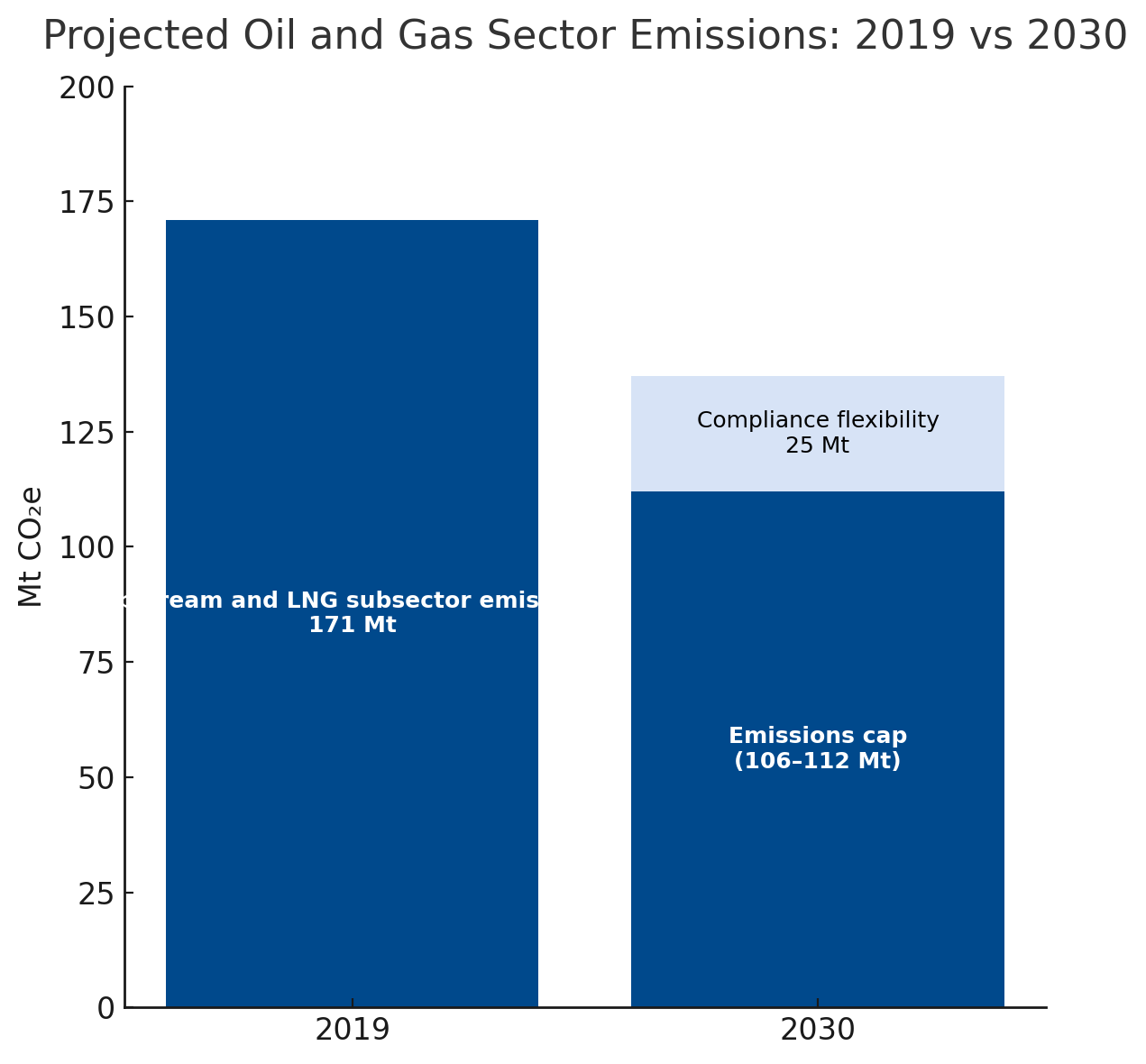

Canada’s 2025 Budget has opened a new chapter in its climate policy debate. The government signaled that it could scrap the proposed emissions cap for the oil and gas sector, a move that has stirred both political and industry reactions. First proposed in 2021, the cap was intended to take effect from 2030 and limit greenhouse gas emissions from one of Canada’s largest and most carbon-intensive industries. The policy’s future now appears uncertain. Ottawa argues that it would only have marginal value and strengthened industrial carbon pricing or wider deployment of carbon capture and storage (CCS) technologies could achieve similar goals. The question is whether these tools can deliver equivalent climate outcomes. This uncertainty has placed Canada at a crossroads, balancing climate ambition with economic pragmatism.

Background: From Promise to Pushback

The emissions cap originated under Prime Minister Justin Trudeau’s 2021 Emissions Reduction Plan. Its intent was straightforward: reduce emissions from the oil and gas sector even if production increased. The policy soon met resistance from key provinces such as Alberta and Saskatchewan, which argued it would threaten investment, jobs, and competitiveness. Industry leaders claimed that the cap duplicated existing carbon-pricing systems and could disrupt Canada’s energy exports. By 2025, political tensions had intensified. The Budget document stated that the cap “would no longer be required as it would have marginal value,” reflecting a shift toward alternative policy instruments. Canada’s oil and gas industry currently accounts for about 27 percent of the country’s total emissions, making any potential change in this sector central to national climate outcomes.

Drivers of Change: Economic Pressures, Politics, and Market Logic

Several forces have converged to challenge the proposed cap, driven by three main dynamics:

- Economic competitiveness: Concerns that strict emission caps could shift investment toward the US, where clean-energy incentives are favored over regulation.

- Political strategy: Balancing national climate goals with regional economic realities and electoral considerations.

- Market-based philosophy: Guided by Mark Carney’s belief in carbon pricing and transition finance as central tools for sustainable decarbonization.

These factors overlap and reinforce one another. Economic competitiveness is a key concern, particularly as the United States pursues clean-energy growth through the Inflation Reduction Act (IRA), which focuses on subsidies and investment incentives rather than strict emission limits. Ottawa’s policymakers fear that hard caps could divert capital southward, leaving Canadian industries at a disadvantage. Political calculations also play a role. With federal elections on the horizon, the government is seeking a policy approach that balances climate credibility with regional and economic sensitivities. Another influential factor is the philosophy of former Bank of England Governor Mark Carney, whose approach to climate policy emphasizes market-based solutions. Carney argues that credible transition finance, underpinned by carbon pricing and private investment, offers a sustainable path toward decarbonization. This perspective aligns with Ottawa’s growing preference for flexible, market-driven instruments over direct regulation.

Global Context and Implications: Canada’s Pivot in a US–EU World

The potential decision to remove the proposed cap has international implications. While neither the United States nor the European Union has officially commented, both are closely monitoring Canada’s evolving policy. The EU’s Carbon Border Adjustment Mechanism (CBAM) could increase pressure on Canadian exporters if the domestic policy framework is viewed as less stringent. This means that weakening regulation could lead to higher costs for Canadian goods entering European markets. Conversely, Canada’s emphasis on industrial carbon pricing mirrors the US approach, aligning more closely with Washington’s incentive-based model. The uncertainty also raises questions about Canada’s alignment with G7 climate commitments and its credibility at future COP negotiations. ESG investors may interpret this situation as a sign of policy volatility, which could affect capital allocation toward Canadian clean-tech and energy-transition projects. For provincial governments, especially those reliant on fossil fuel revenues, the policy direction will shape future negotiations over resource development and federal funding.

Conclusion: Canada’s Net-Zero Credibility at Stake

Whether Ottawa ultimately decides to abandon or retain the proposed emissions cap, the outcome will influence Canada’s trajectory toward its 2030 and 2050 climate targets. The challenge is not simply technical but strategic: to show that market-based tools can achieve real emissions reductions without undermining economic growth. For Canada’s global partners, the credibility of its policy framework will determine its standing within G7 climate leadership and its access to international green investment. The world is watching how Canada balances its resource-driven economy with its net-zero ambitions. Consistency, transparency, and measurable progress will decide whether this crossroads leads to leadership or lost momentum.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. ASUENE serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.