- Article Summary

-

Understanding the Importance of TCFD in ESG Disclosure

The Task Force on Climate-related Financial Disclosures (TCFD), established by the Financial Stability Board (FSB), provides a globally recognized framework for companies to disclose climate-related financial risks and opportunities. As investors and regulators increasingly demand transparency in Environmental, Social, and Governance (ESG) factors, aligning disclosures with TCFD has become critical.

TCFD’s structure consists of four core elements:

- Governance: The organization’s governance around climate-related risks and opportunities.

- Strategy: The actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning.

- Risk Management: How the organization identifies, assesses, and manages climate-related risks.

- Metrics and Targets: The metrics and targets used to assess and manage relevant climate-related risks and opportunities.

Key Benefits of TCFD-Based Disclosure

| Benefit | Description |

|---|---|

| Investor Confidence | Provides clear, consistent climate risk information. |

| Regulatory Alignment | Meets growing global ESG regulatory requirements. |

| Strategic Risk Management | Integrates climate-related risk into core business planning. |

| Enhanced Corporate Reputation | Demonstrates proactive sustainability leadership. |

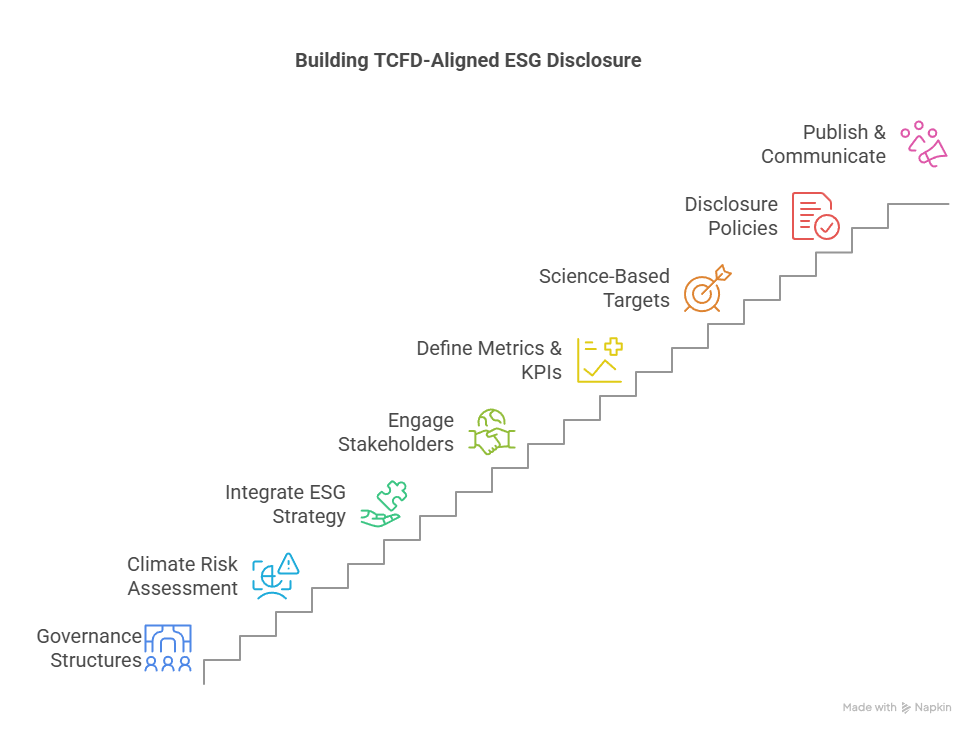

Step-by-Step Guide: Building TCFD-Aligned ESG Disclosure

Step 1: Establish Governance Structures

Assign responsibility for climate-related disclosures to board-level committees and senior executives. Define roles, responsibilities, and oversight mechanisms.

Step 2: Conduct a Climate Risk Assessment

Use scenario analysis to identify physical and transition risks. Evaluate how climate change could impact operations, supply chains, and markets.

Step 3: Integrate ESG into Corporate Strategy

Align ESG objectives with the company’s mission, vision, and strategic planning. Set long-term sustainability goals with board-level buy-in.

Step 4: Identify and Engage Stakeholders

Engage investors, customers, suppliers, and employees. Understand their ESG expectations and incorporate their feedback into the disclosure framework.

Step 5: Define Metrics and KPIs

Choose relevant indicators (e.g., Scope 1, 2, and 3 GHG emissions, water usage, energy intensity). Ensure consistency with global reporting standards like GRI, SASB, and CDP.

Step 6: Set Science-Based Targets

Set measurable and time-bound targets aligned with the Paris Agreement. Regularly review and update targets to reflect business evolution.

Step 7: Develop Disclosure Policies and Controls

Build internal controls for data collection, analysis, and assurance. Document methodologies for ESG data and ensure audit-readiness.

Step 8: Draft the ESG Report

Align your report with TCFD’s four pillars. Use visual elements, narratives, and case studies to communicate effectively.

Step 9: Validate Through External Review

Seek third-party assurance or verification to enhance credibility. Leverage external frameworks to benchmark disclosure practices.

Step 10: Publish and Communicate Transparently

Distribute your report through annual filings, investor briefings, and corporate websites. Ensure clarity, accessibility, and consistency across platforms.

Best Practices and Industry Examples

Leading companies across sectors are adopting TCFD to drive ESG leadership. Below is a snapshot of how different industries are applying the framework:

TCFD Application by Sector

| Industry | Governance | Risk Strategy | Metrics Used |

| Financial | Climate oversight by board | Scenario analysis on portfolios | Carbon footprint, financed emissions |

| Manufacturing | CSO-led ESG committees | Physical risk mapping | Energy use per unit, emissions ratios |

| Retail | ESG embedded in strategy | Supply chain transition risks | Scope 3 emissions, supplier audits |

Importance of a Comprehensive GHG Inventory Including Scope 3

A robust greenhouse gas (GHG) inventory that includes Scope 3 emissions is fundamental to accurate climate risk identification and strategic ESG planning. Scope 3 covers all indirect emissions in a company’s value chain, such as those from purchased goods and services, transportation, waste disposal, and use of sold products. These emissions often account for the majority of a company’s total carbon footprint.

Without visibility into Scope 3 emissions, organizations may significantly underestimate their exposure to transition risks, including policy changes, shifts in consumer preference, and supply chain disruptions. Moreover, addressing Scope 3 is essential for meaningful decarbonization efforts and meeting stakeholder expectations for full transparency.

Why Scope 3 Matters for Risk Identification

| Factor | Relevance |

| Value Chain Vulnerability | Uncovers hidden risks in upstream and downstream activities. |

| Accurate Scenario Analysis | Enables realistic modeling of climate-related financial impacts. |

| Target Setting Integrity | Supports science-based targets that reflect total emissions profile. |

| Stakeholder Trust | Demonstrates accountability and commitment to comprehensive reporting. |

Establishing a detailed Scope 1, 2, and 3 inventory not only fulfills TCFD expectations but also strengthens an organization’s ability to proactively manage ESG risks and enhance long-term resilience.

Overcoming Challenges in ESG Disclosure

While TCFD offers a robust structure, companies face several challenges when implementing ESG disclosure:

- Data Availability: Gathering accurate and consistent climate-related data, especially Scope 3 emissions.

- Internal Alignment: Coordinating among departments (e.g., finance, operations, sustainability) for holistic disclosure.

- Scenario Analysis Complexity: Difficulty in selecting relevant climate scenarios and translating them into financial impact.

- Resource Constraints: ESG initiatives require investment in systems, training, and expert consultation.

Solutions

| Challenge | Mitigation Strategy |

| Scope 3 Data Gaps | Use supplier questionnaires, emissions databases, proxy models |

| Scenario Complexity | Follow NGFS, IEA, or IPCC frameworks for scenario planning |

| Interdepartmental Gaps | Appoint ESG coordinators, establish cross-functional teams |

| Resource Issues | Start small with material disclosures; scale as capacity grows |

Conclusion: Taking Action for Long-Term Value

Implementing ESG disclosure based on TCFD is more than a compliance exercise—it’s a strategic imperative. As stakeholders demand greater transparency, the companies that respond with robust, credible disclosures will position themselves for resilience and growth in a low-carbon economy.

By following the 10 steps outlined above, companies can systematically develop an ESG disclosure framework that satisfies regulators, informs investors, and engages stakeholders. The journey requires commitment and coordination but yields substantial long-term value.

Final Tip: Continuous Improvement

Disclosure is not a one-time task. Annual reviews, stakeholder feedback, and alignment with evolving standards (like ISSB or EU CSRD) will ensure your ESG strategy remains relevant and impactful.

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.