- Article Summary

-

Introduction

As climate change accelerates, corporations face increasingly complex threats. From acute physical risks like extreme weather events to chronic shifts such as rising temperatures and sea levels, the implications for operations and financial performance are profound. Beyond these, transition risks (stemming from regulatory shifts, market volatility, and evolving consumer expectations) introduce an entirely different category of challenges.

To remain competitive and sustainable, companies must adopt a strategic approach to climate resilience. The Task Force on Climate-related Financial Disclosures (TCFD) provides a globally recognized framework to assess and disclose these climate-related risks and opportunities. This article explores how organizations can leverage the TCFD to identify, evaluate, and manage acute, chronic, and transition risks to strengthen long-term resilience.

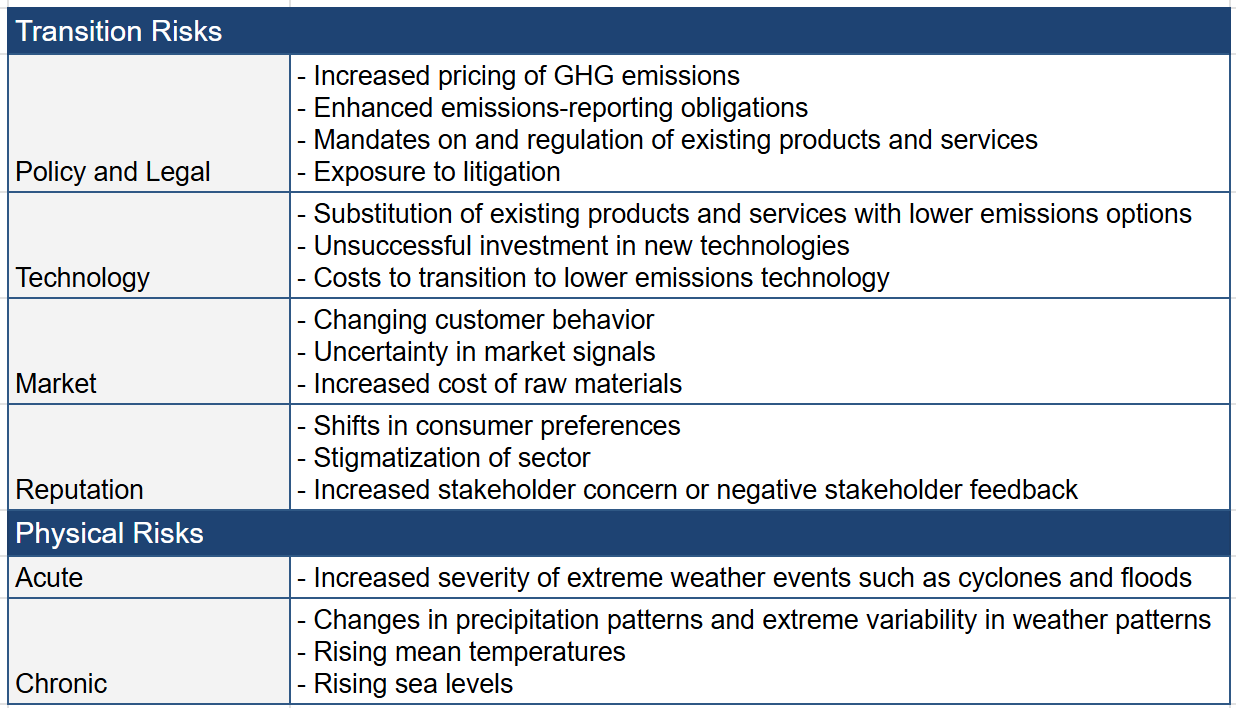

Understanding Climate Risk Categories in the TCFD Framework

The TCFD breaks down climate risks into two broad categories: physical and transition. Physical risks include acute (sudden, high-impact events like hurricanes and wildfires) and chronic (gradual changes such as sea-level rise and shifting precipitation patterns). Transition risks stem from societal and economic efforts to mitigate climate change.

The following table provides a concise summary of each category:

These risks are interconnected. For example, policy changes (transition risks) may be accelerated following severe climate events (acute physical risks). Companies must adopt a holistic approach to climate scenario analysis to reflect these linkages.

Integrating Acute and Chronic Risks into Corporate Strategy

Acute physical risks are often easier to quantify due to their immediate and observable impact. For example, a hurricane might halt operations at a manufacturing site for several weeks. Chronic risks, however, require long-term modeling and are frequently underestimated. Rising heat may degrade infrastructure performance and increase cooling energy demands.

Risk mapping and asset-level exposure analysis are key tools. Companies should assess how each asset (plants, warehouses, logistics hubs) is exposed to localized acute and chronic risks. Geographic information systems (GIS), climate projections (such as CMIP6), and catastrophe modeling tools are essential.

Below is an illustrative chart showing projected changes in chronic risk indicators by 2050 under a high-emissions scenario (RCP 8.5):

| Risk Factor | 2020 Level | 2050 Projection | Impact on Operations |

|---|---|---|---|

| Avg. Temperature | 15.5°C | 18.2°C | Increased cooling costs, worker stress |

| Sea Level (cm) | 0 | +35 | Coastal asset inundation |

| Drought Frequency | 1 in 10 years | 1 in 5 years | Water scarcity for operations |

Strategic actions include:

- Relocating or reinforcing high-risk assets

- Revising insurance and capital planning

- Diversifying suppliers across geographies

- Investing in on-site renewable generation to mitigate grid risks

Integrating these physical risks into Enterprise Risk Management (ERM) and financial planning ensures that climate resilience is not an afterthought but a core component of long-term value creation.

Managing Transition Risks in a Rapidly Evolving Policy Landscape

Transition risks can escalate quickly, driven by shifts in regulation, technology, market preferences, and investor pressure. The cost of inaction can be substantial, especially if a company’s business model is misaligned with a low-carbon economy.

Carbon pricing is a prime example. According to the World Bank, over 70 carbon pricing initiatives have been implemented worldwide. For a manufacturing firm emitting 100,000 metric tons of CO₂ annually, even a modest carbon price of $50/ton would result in $5 million in annual costs.

The chart below illustrates the growing number of jurisdictions with carbon pricing mechanisms:

To manage transition risks effectively:

- Conduct scenario analysis using IEA Net Zero or NGFS pathways

- Quantify financial exposure to future carbon pricing

- Engage with policymakers through industry associations

- Align product portfolios with low-carbon alternatives

- Establish internal carbon pricing to guide investment decisions

Transition readiness can also boost access to sustainable finance. Green bonds and sustainability-linked loans often require climate-risk disclosure and mitigation strategies aligned with TCFD principles.

Embedding TCFD into Governance, Risk Management, and Metrics

A robust climate resilience strategy involves integrating TCFD-aligned practices into corporate governance, risk management, and performance metrics.

Governance: Climate risk oversight should be embedded at the board level, with clear roles for audit and sustainability committees. Executive incentives tied to climate performance indicators (such as emissions reduction or scenario planning milestones) reinforce accountability.

Risk Management: Climate risks should be evaluated alongside financial, operational, and reputational risks. Companies should adopt dual materiality; assessing not only how climate affects the business, but how the business impacts climate.

Metrics & Targets:

- Scope 1, 2, and 3 emissions

- Climate Value-at-Risk (VaR)

- Capital expenditure aligned with transition plans

- Share of revenues from low-carbon products

An example TCFD-aligned KPI dashboard might look like this:

| Metric | 2023 Value | 2025 Target |

|---|---|---|

| Scope 1 & 2 Emissions (tCO₂e) | 150,000 | 100,000 |

| Scope 3 (Purchased Goods) | 2.1M | 1.6M |

| CapEx for Net-Zero Projects (%) | 22% | 40% |

| % Renewable Energy Use | 45% | 80% |

Regular disclosure via annual sustainability or climate reports in line with TCFD builds stakeholder trust and signals preparedness to regulators and investors.

Conclusion

Climate-related risks are no longer hypothetical. As physical impacts intensify and the world accelerates toward decarbonization, companies that proactively assess and address these risks will be better positioned to thrive.

The TCFD framework offers a strategic roadmap for embedding climate resilience into business operations. By evaluating acute and chronic physical risks alongside dynamic transition risks, companies can adapt their assets, operations, and governance for a changing world.

Incorporating these insights into corporate strategy is not merely a compliance exercise — it’s a catalyst for innovation, competitiveness, and long-term value. The future will favor companies that can not only withstand climate disruption, but lead the way in shaping a resilient, low-carbon economy.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.