- Article Summary

-

Sustainability reporting has evolved from a CSR initiative to a regulated corporate obligation. As investors, regulators, and consumers demand more transparency, companies are transitioning from siloed sustainability reports to integrated ESG disclosures that connect non-financial and financial performance. In 2024 and beyond, the challenge is no longer whether to disclose—but how to disclose effectively, strategically, and in compliance with multiple overlapping frameworks.

This article explores the transformation from traditional sustainability reporting to integrated ESG disclosure, with a focus on aligning with global frameworks such as the CSRD, ISSB, GRI, and SASB. We will also examine how forward-thinking companies are using ESG data not only for compliance but to shape reputation, resilience, and value creation.

The Shift from CSR to ESG: What Has Changed?

In the past, sustainability reporting was voluntary and often qualitative. Today, under new standards like the EU CSRD and the ISSB’s IFRS S1 and S2, ESG disclosure is mandatory, quantitative, and subject to audit. The concept of double materiality — covering both financial impact and impact on society/environment — is redefining what must be reported.

Table: Key ESG Reporting Frameworks Compared

| Framework | Scope | Mandatory (EU/Global) | Key Feature |

|---|---|---|---|

| CSRD | EU | Yes (from 2024) | Double materiality, sector-specific standards |

| ISSB S1/S2 | Global | Emerging (2024+) | Climate and general ESG financial risks |

| GRI | Global | Voluntary | Stakeholder impact focus |

| SASB | Global | Voluntary (some use in US) | Financially material topics by sector |

Companies are increasingly harmonizing these frameworks to reduce duplication and provide a cohesive narrative across investor documents, sustainability portals, and annual reports.

Building an Integrated ESG Narrative

Effective ESG disclosure is not about data dumping. It requires a coherent narrative that links strategy, risk, governance, and performance. Leading companies use integrated reports to:

- Connect ESG performance to long-term business objectives.

- Show how climate and social risks are managed through governance.

- Demonstrate impact through quantitative KPIs (e.g., emissions, diversity, waste).

This approach is exemplified by firms like SAP and Unilever, whose integrated reports align ESG targets with financial strategy. ESG information is no longer supplementary—it is embedded in boardroom decisions and investor communications.

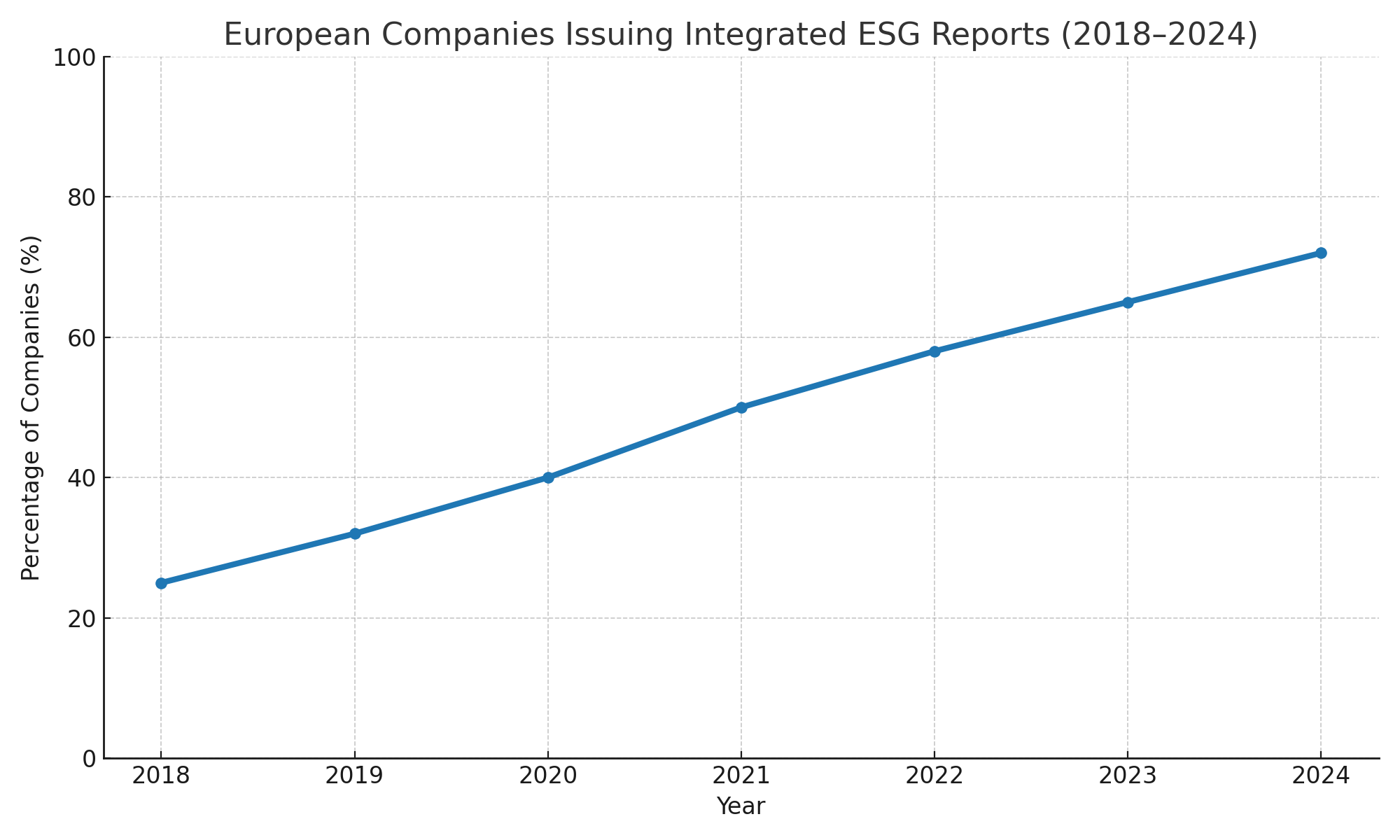

Graph: Percentage of European Companies Issuing Integrated ESG Reports (2018–2024)

Digital Tools and ESG Data Quality

As disclosure obligations rise, so too does the need for robust data systems. Manual spreadsheets can no longer support the scale and complexity of ESG reporting. Organizations are investing in ESG software platforms that can:

- Automate data collection from across business units.

- Ensure audit-readiness and traceability.

- Align disclosures with multiple standards.

- Provide dashboards and analytics for internal and external stakeholders.

Popular tools include Workiva, Enablon, and Greenstone, which help centralize ESG workflows and reduce reporting fatigue.

Strategic Benefits Beyond Compliance

Integrated ESG disclosure offers strategic advantages:

- Investor access: ESG transparency attracts capital from sustainable finance.

- Brand trust: Stakeholders value data-backed social and environmental claims.

- Operational insight: KPIs reveal inefficiencies and risks to address.

- Market differentiation: Being ahead of regulatory compliance enhances reputation.

For example, Patagonia’s reporting transparency has deepened consumer loyalty, while Neste’s ESG-aligned disclosures have helped attract green bond financing.

Conclusion

The future of sustainability reporting lies in integration—of standards, systems, and strategy. Companies that embrace this shift will not only comply with complex ESG mandates but also build more resilient, transparent, and value-driven organizations. By moving beyond check-the-box reporting toward strategic ESG communication, they position themselves as leaders in a rapidly changing global economy.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.