- Article Summary

-

Once viewed primarily as facilitators of capital, financial institutions now find themselves on the frontlines of global sustainability. Through lending, investing, and underwriting, the financial sector holds a powerful lever for driving ESG-aligned outcomes across the global economy. This article explores five pivotal ESG trends transforming the finance industry in 2024 and beyond.

Sustainable Finance as a Core Business Driver

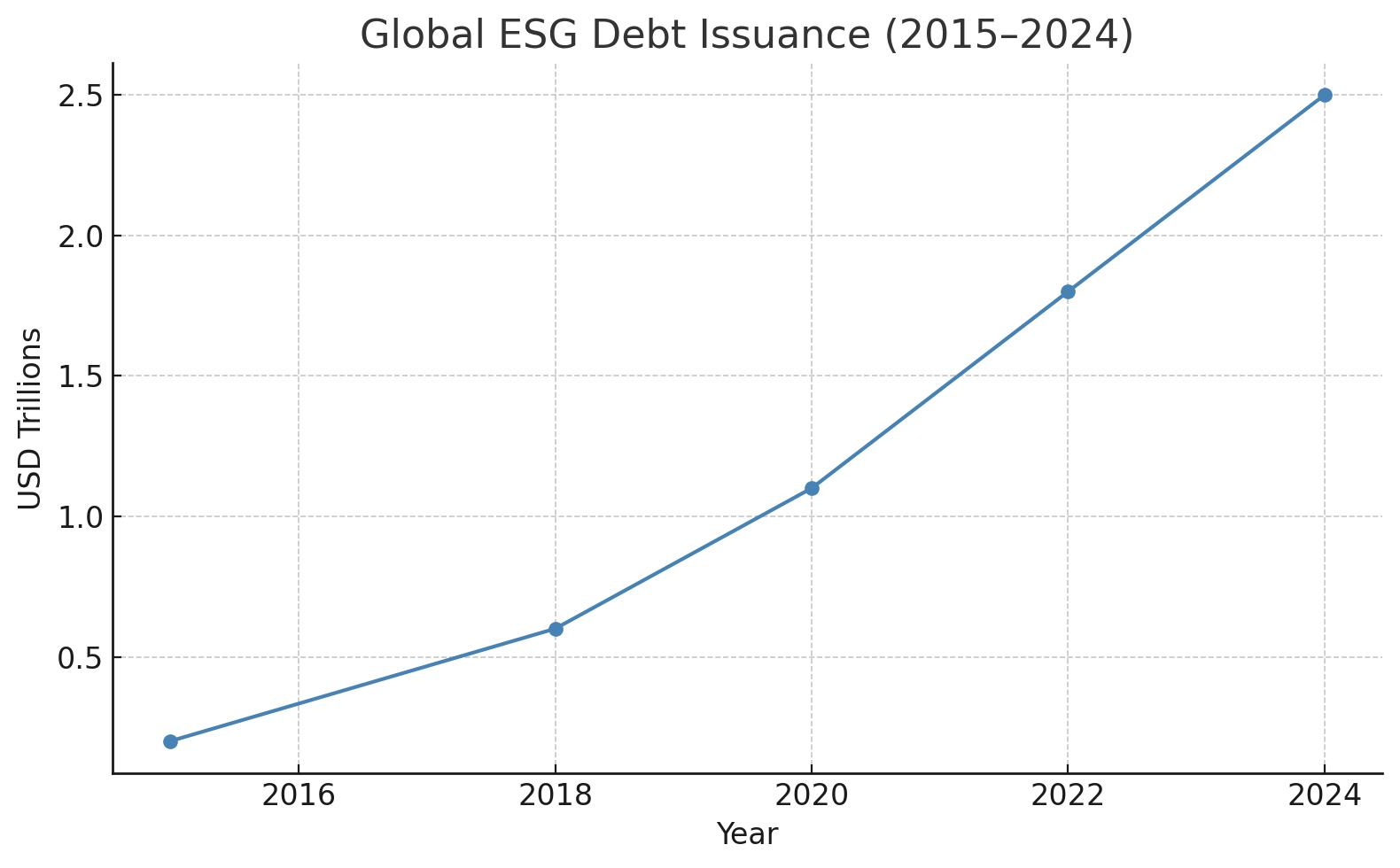

ESG-aligned financing has moved from a niche market to a core revenue driver for banks and asset managers. The market for green, social, and sustainability-linked bonds has continued to surge, with demand from both issuers and investors.

Key Instruments:

- Green Bonds and Sustainability-linked Bonds (SLBs)

- ESG-themed ETFs and mutual funds

- Transition finance for hard-to-abate sectors

Global ESG Debt Issuance (2015–2024, in USD Trillions)

Year | ESG Debt Issuance (USD Trillions)

---------|-----------------------------------

2015 | 0.2

2018 | 0.6

2020 | 1.1

2022 | 1.8

2024 (E) | 2.5

Major institutions such as BNP Paribas, HSBC, and Goldman Sachs now report ESG finance targets alongside their quarterly earnings.

Climate Risk Disclosure and Portfolio Decarbonization

Banks and investors are under pressure to measure and reduce the emissions associated with their financing and investment portfolios—known as “financed emissions.”

Emerging Practices:

- Science-based targets (SBTi) for portfolio alignment

- Scenario analysis based on NGFS and IPCC models

- Portfolio rebalancing away from high-carbon sectors

Portfolio Alignment Targets (Selected Institutions)

| Institution | Net-Zero Target Year | Sector Coverage |

|---|---|---|

| BlackRock | 2050 | Asset management |

| JPMorgan Chase | 2050 | Lending & underwriting |

| ING | 2040 | Power, real estate, shipping |

| Standard Chartered | 2050 | Project finance, energy |

Financed emissions are now reported under frameworks like PCAF, and included in TCFD-aligned disclosures.

Inclusion, Access, and the “S” in ESG

Financial inclusion is emerging as a major social priority. Access to fair and affordable financial services is critical to reducing inequality and building economic resilience.

Focus Areas:

- Microfinance and community banking for underserved populations

- Women- and minority-owned business lending programs

- Digital financial literacy initiatives

Financial Inclusion Metrics (2024)

| Indicator | Global Average | Best Practice Regions |

|---|---|---|

| Adults with a Bank Account (%) | 76% | 95%+ (Nordics, Singapore) |

| Women with Digital Access to Finance | 63% | 90%+ (South Korea, Estonia) |

| SMEs with Access to Credit (%) | 45% | >70% (Germany, Canada) |

The growing link between financial inclusion and ESG performance is reflected in investor stewardship and ESG scoring models.

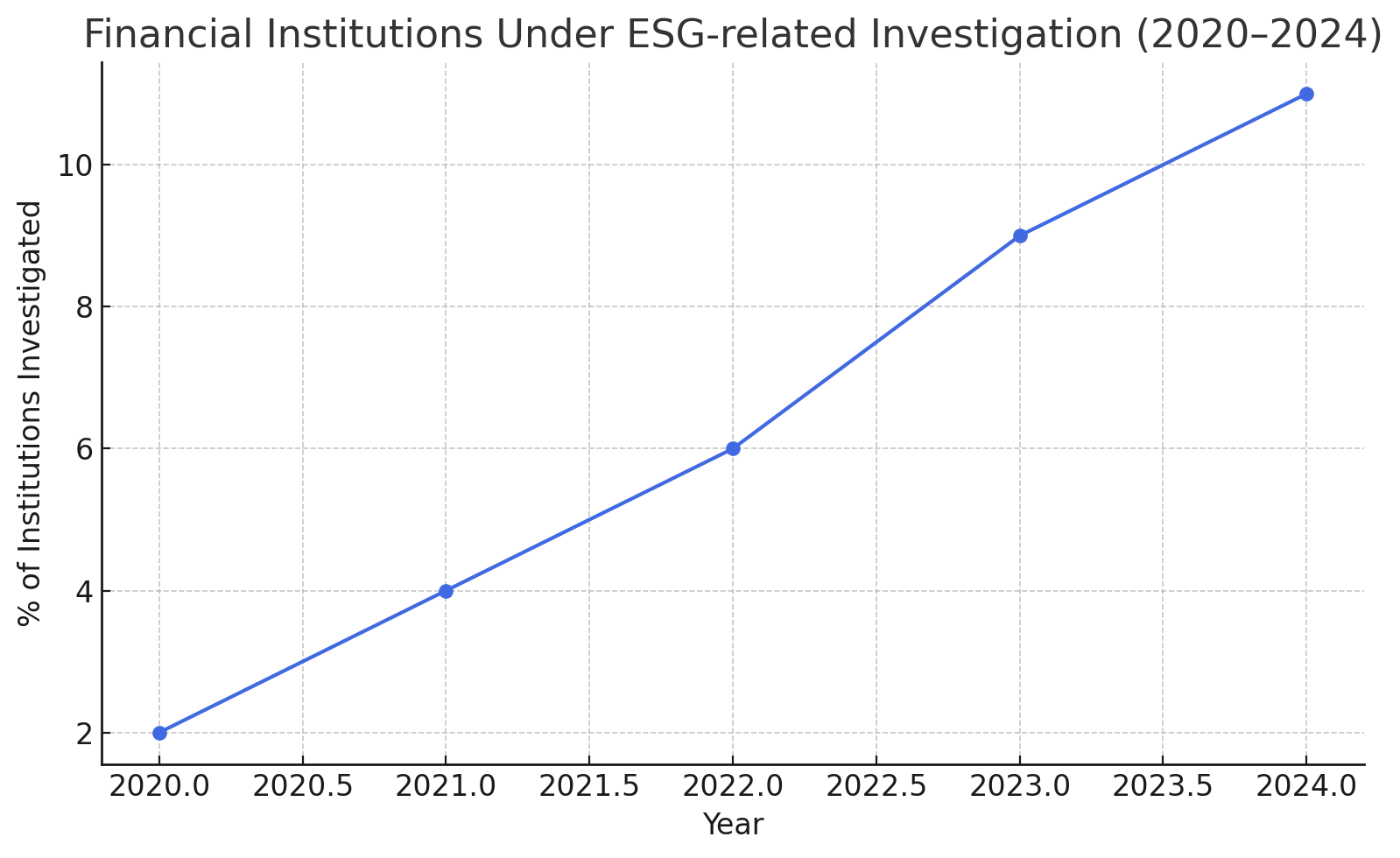

ESG Governance and Greenwashing Scrutiny

With ESG claims under intense scrutiny, financial firms are being held accountable for how they govern sustainability initiatives. Regulators are cracking down on mislabeling and weak ESG governance structures.

Key Governance Themes:

- ESG-specific board committees

- Integration of ESG metrics into compensation schemes

- Audit and assurance of ESG disclosures

Share of Financial Institutions Subject to ESG-related Investigations (2020–2024)

Year | % of Institutions Investigated

---------|-------------------------------

2020 | 2%

2021 | 4%

2022 | 6%

2023 | 9%

2024 (E) | 11%

Regulators in the EU, U.S., and Asia have issued or proposed stricter ESG labeling, disclosure, and fund classification rules (e.g., SFDR, SEC climate disclosure rule, AMF doctrine).

ESG Data, Taxonomies, and Regulatory Alignment

As ESG standards proliferate globally, harmonizing definitions, metrics, and taxonomies is becoming crucial. Institutions are investing in technology and compliance to keep up.

Key Frameworks:

- EU Taxonomy and SFDR for sustainable investment classification

- ISSB and EFRAG (CSRD) for mandatory ESG reporting

- Local taxonomies in China, ASEAN, and Latin America

ESG Reporting and Compliance Adoption (2024)

| Framework/Standard | Financial Institutions Adopting (%) |

|---|---|

| SFDR (EU) | 92% (EU firms) |

| ISSB (Global) | 38% |

| CSRD (EU) | 47% |

| SASB/TCFD (Global) | 61% |

| Local Taxonomies | 31% (non-OECD regions) |

Cross-border financial flows now depend on compatibility with these evolving standards, affecting everything from fund flows to bank risk ratings.

Conclusion

The financial sector is no longer a passive allocator of capital—it is an active agent in the sustainability transition. ESG now permeates lending decisions, product development, portfolio management, and client engagement.

As regulation tightens and stakeholder expectations evolve, financial institutions must move from ESG intention to ESG execution. The future of finance lies not only in managing capital—but in managing its impact.

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.