- Article Summary

-

Introduction

Artificial intelligence is reshaping the global economy at a pace few technologies have matched. From generative models to enterprise automation, AI systems rely on vast computing infrastructure that must operate continuously and at high intensity. This digital expansion is now translating directly into physical energy demand. Across the United States and other advanced economies, utilities and policymakers are confronting a sharp rise in electricity consumption driven by data centers built to support AI workloads. In response, a growing number of energy providers are turning back to natural gas power generation as a fast and scalable solution. This development is unfolding at a moment when governments and corporations are publicly committed to net zero targets, raising fundamental questions about the compatibility of AI-led growth and climate goals.

The return of gas power is not occurring in isolation. It reflects structural constraints in power grids, slow permitting processes for renewable infrastructure, and the technical demands of AI computing that favor reliability over variability. Yet gas-fired power plants are long-lived assets with emissions profiles that extend decades into the future. The choices made today to support AI infrastructure will shape national emissions trajectories well beyond current planning horizons. As a result, the relationship between AI, electricity demand, and fossil fuel investment has become a defining climate issue of this decade.

Why AI Data Centers Are Driving Gas Power Expansion

AI data centers differ significantly from traditional commercial or industrial electricity users. Training and operating large AI models requires constant, high-density power with minimal tolerance for interruption. Even short outages can disrupt operations, damage hardware, or compromise data integrity. While renewable energy capacity has expanded rapidly, wind and solar generation remain intermittent and location-dependent. Grid-scale storage and transmission upgrades, which could mitigate these challenges, often face multi-year development timelines.

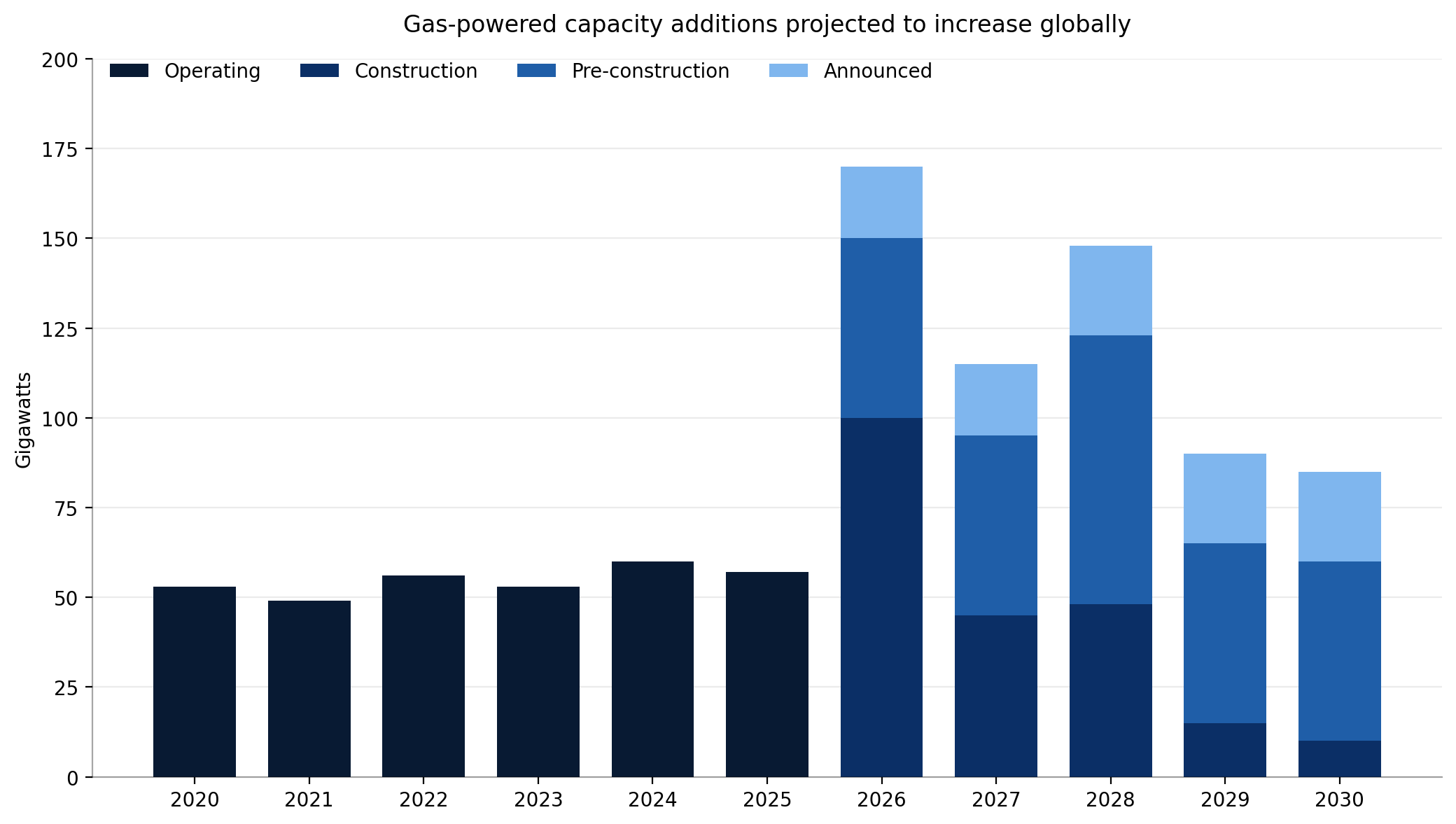

Natural gas plants offer utilities a comparatively quick solution. Gas facilities can be permitted and constructed faster than large renewable projects paired with storage, and they provide dispatchable power that can respond immediately to fluctuations in demand. In regions experiencing rapid data center clustering, such as parts of the US Midwest and Southeast, utilities are citing reliability concerns as justification for new gas investments. These decisions are often framed as temporary or transitional measures, intended to support economic growth while cleaner alternatives scale up.

However, infrastructure decisions in the power sector are rarely temporary in practice. Once built, gas plants typically operate for 30 years or more. The surge in AI-related demand is therefore encouraging utilities to commit to long-term fossil fuel capacity based on near-term reliability needs. This dynamic highlights a misalignment between digital growth timelines and energy transition planning.

Climate Implications and Emissions Lock-In

The expansion of gas power to support AI data centers carries significant climate implications. Power sector emissions in several advanced economies had been declining due to coal retirements and renewable deployment. New gas capacity risks slowing or reversing this trend. While gas emits less carbon dioxide than coal when burned, it remains a fossil fuel with substantial lifecycle emissions. Methane leakage during extraction, processing, and transportation further increases its climate impact.

For corporate climate strategies, these developments introduce new complexities. Many technology companies have made commitments to source electricity from renewable energy through power purchase agreements or renewable energy credits. Yet when utilities add gas capacity to meet data center demand, overall grid emissions can rise even if individual companies claim clean energy procurement. This creates a gap between reported progress on Scope 2 emissions and the actual emissions intensity of electricity systems.

The risk of carbon lock-in is particularly acute. Investments made today in gas infrastructure will influence dispatch decisions, grid economics, and policy choices for decades. As AI adoption accelerates, the cumulative emissions associated with supporting infrastructure could become a material barrier to achieving national climate targets.

Policy and Corporate Accountability Challenges

Current policy frameworks are struggling to keep pace with the speed of AI-driven demand growth. Electricity demand forecasting has historically been incremental, assuming gradual changes in consumption patterns. AI data centers break this model by adding large, concentrated loads within short timeframes. Regulatory processes for generation and transmission planning often lack mechanisms to account for this structural shift.

Corporate accountability is also fragmented. Technology firms typically do not own or operate the power plants supplying their electricity. Responsibility for generation choices rests with utilities, which are regulated at the state or regional level. This separation allows companies to pursue aggressive AI expansion while maintaining formal climate commitments, even as utilities invest in new fossil fuel capacity on their behalf.

Investor and civil society scrutiny is increasing. Questions are emerging about whether existing disclosure regimes adequately capture the climate impact of AI infrastructure. As sustainability reporting standards evolve, pressure is likely to grow for clearer alignment between corporate growth strategies, electricity procurement, and real-world emissions outcomes.

Conclusion

The rapid rise of artificial intelligence is transforming electricity demand from a background consideration into a central climate variable. Data centers are becoming anchor loads on power systems, influencing generation investment decisions at scale. The renewed reliance on gas power to meet AI-driven demand underscores the tension between digital innovation and decarbonization pathways.

Addressing this challenge will require coordinated action. Grid planning must integrate realistic projections of AI growth. Clean energy deployment and storage infrastructure need to accelerate to provide reliable alternatives to fossil fuels. Corporate climate strategies must extend beyond contractual procurement to engage with the physical realities of power systems. The trajectory of AI development will test whether economic and technological progress can align with credible climate action or whether short-term solutions will define long-term emissions outcomes.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.