- Article Summary

-

Introduction

Sustainability has shifted from a voluntary initiative to a regulated, investor-driven requirement. According to PwC’s Global Sustainability Reporting Survey, 79% of companies worldwide are now disclosing ESG information, yet only about a quarter deliver investment-grade, assured data. This gap reveals a critical challenge: while sustainability reporting adoption is skyrocketing, quality, comparability, and consistency remain low. To bridge this divide, businesses are increasingly turning to sustainability software solutions that streamline reporting, improve data quality, and deliver strategic insights. In 2025, adopting these platforms is no longer optional; it is essential for survival and growth.

Reason 1: Regulatory compliance is non-negotiable

The regulatory landscape is tightening across every major market. California’s SB 253 and SB 261, the EU’s Corporate Sustainability Reporting Directive (CSRD), and the U.S. SEC’s climate disclosure rules all require companies to report on climate-related risks and emissions. PwC’s survey highlights that many businesses struggle with fragmented frameworks, inconsistent disclosure requirements, and overlapping standards. Without technology to centralize and align data across jurisdictions, companies face increased compliance risks. Sustainability software automates reporting workflows, ensures adherence to multiple frameworks, and reduces the likelihood of costly errors or penalties.

Reason 2: Efficiency over spreadsheets

Traditional ESG reporting methods, often based on spreadsheets and manual data entry, are no longer sufficient. As companies expand their reporting scope to include Scope 1, 2, and 3 emissions, supply chain data, and other ESG indicators, the volume of information becomes overwhelming. PwC found that data collection and management remain one of the most significant challenges companies face. Sustainability software provides automation, real-time data integration, and streamlined workflows. By eliminating duplication and human error, these tools save time and resources while improving accuracy, which is a critical step for scaling ESG programs.

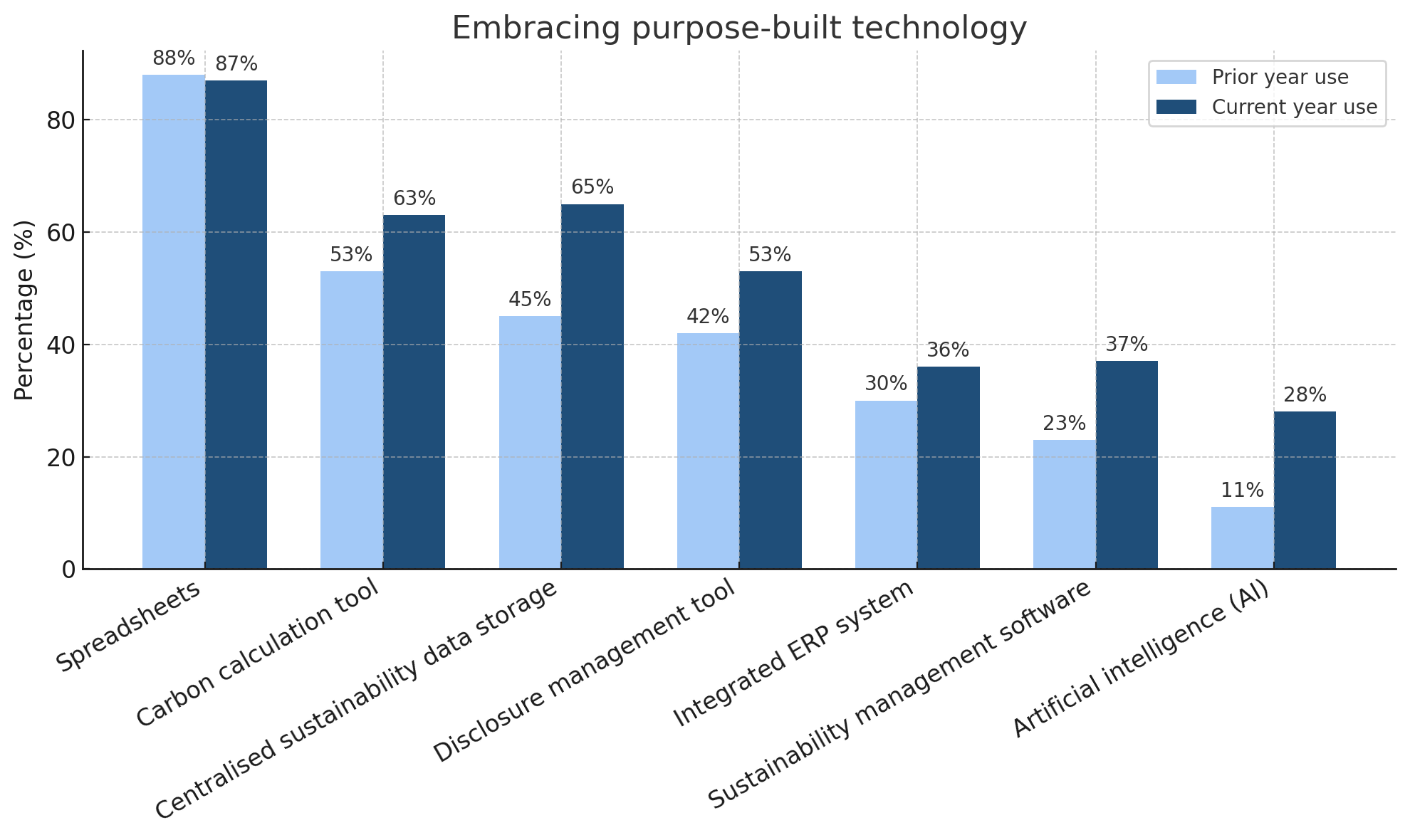

The PwC survey also illustrates this trend clearly. While spreadsheets remain widely used, the adoption of specialized tools such as carbon calculation platforms, disclosure management software, and AI-driven solutions has accelerated year over year.

Reason 3: Investor and stakeholder trust

Trust is the currency of sustainable business. Investors, regulators, and customers increasingly demand transparency and accountability in ESG reporting. However, PwC’s research shows that ESG data often lacks the rigor of financial disclosures, leading to skepticism from stakeholders. Sustainability software addresses this challenge by enabling audit-ready reporting, complete with traceable data trails and assurance capabilities. By ensuring high-quality, consistent disclosures, companies can build credibility, strengthen investor confidence, and enhance their reputation in the marketplace.

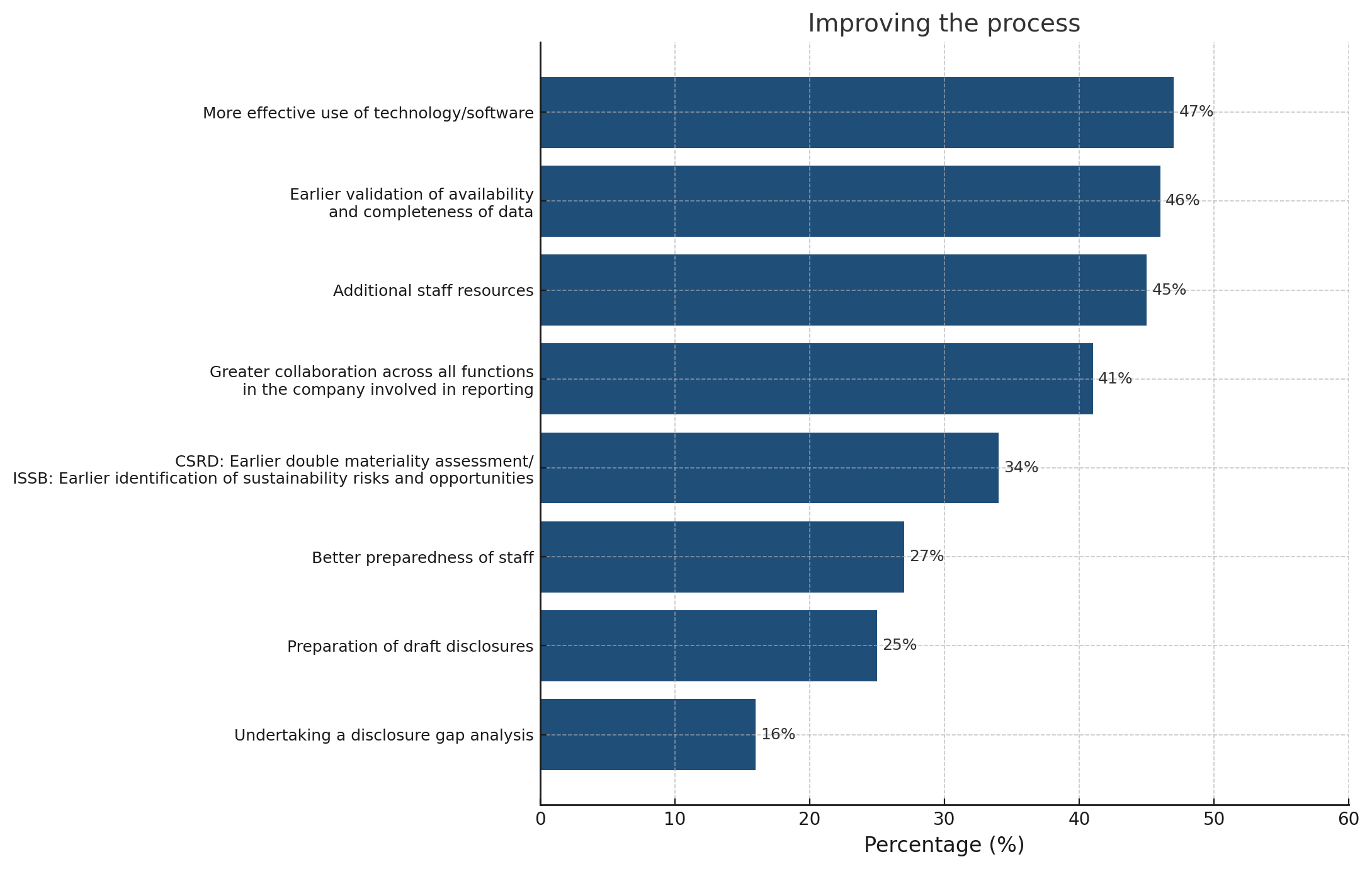

PwC’s survey further highlights that companies themselves recognize this need for improvement. When asked what would have strengthened their ESG reporting processes, nearly half of respondents pointed to more effective use of technology and software as the top answer. Earlier validation of data and greater collaboration across functions were also cited, but the common theme was clear: better systems and smarter tools are critical for building trust.

Reason 4: Supply chain and Scope 3 visibility

For most organizations, Scope 3 emissions, those generated across the supply chain, account for 70–90% of their total carbon footprint. Despite this, PwC reports that Scope 3 data is the least reliable and most difficult to measure. Without clear visibility, companies risk underestimating their true environmental impact and missing opportunities for improvement. Sustainability software empowers businesses to collect standardized supplier data, identify hotspots in the value chain, and collaborate with partners to reduce emissions. This level of insight not only supports compliance but also drives resilience and competitiveness.

Reason 5: From compliance to strategic insights

While compliance remains the immediate driver for ESG reporting, the real value of sustainability software lies in its ability to generate insights. Beyond tracking emissions and reporting metrics, advanced platforms can model scenarios, forecast risks, and identify opportunities for cost savings and innovation. By turning ESG data into actionable intelligence, businesses can move from treating sustainability as a reporting burden to embracing it as a strategic advantage. This evolution is essential in 2025, where proactive climate strategies increasingly shape access to capital, customer loyalty, and long-term growth.

Conclusion

Sustainability software is no longer a luxury; it is a necessity. In 2025, businesses must address five core needs: regulatory compliance, operational efficiency, stakeholder trust, supply chain visibility, and strategic insight. PwC’s survey data underscores the urgency: ESG reporting adoption is widespread, but without reliable systems, credibility and compliance are at risk. ASUENE provides an integrated platform designed to meet these challenges, offering end-to-end solutions for carbon accounting, disclosure management, and sustainability strategy. With ASUENE , businesses can move beyond compliance and unlock the full potential of sustainability as a driver of value, resilience, and growth.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. ASUENE serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.