In an era where environmental transparency is becoming a cornerstone of global business ethics, California is pioneering with new climate disclosure laws that compel businesses to unveil their environmental footprints and related risks. These laws are not just a regional change but are part of a growing trend affecting U.S. businesses across all sectors, influencing investor relations and regulatory compliance. This article aims to unpack these new regulations, explore their implications for U.S. companies, and provide actionable insights to navigate this changing terrain effectively. As businesses across the nation watch closely, understanding and adapting to these rules will be crucial for future success and sustainability.

Understanding Climate Disclosure

Climate disclosure entails the process by which companies report their environmental impact, including greenhouse gas emissions, energy use, and broader sustainability practices. This transparency is crucial not only for environmental accountability but also for informing stakeholders about the financial risks associated with climate change. California’s approach builds on the Task Force on Climate-related Financial Disclosures (TCFD) recommendations and goes beyond federal initiatives like the SEC’s guidelines, setting a rigorous standard for environmental stewardship.

Overview of the New Laws

California’s new climate disclosure laws, enacted in 2023, mark a significant advancement in environmental accountability. The legislation compels major corporations operating within the state to provide detailed reports on several key environmental metrics by 2025, including their carbon footprints and the financial risks associated with climate change. These requirements, stemming from a trio of legislative measures—Senate Bill (SB) 253, Senate Bill (SB) 261, and Assembly Bill (AB) 1305—aim to ensure comprehensive climate transparency across various sectors, including manufacturing, energy, finance, and beyond.

Senate Bill (SB) 253: Climate Corporate Data Accountability Act

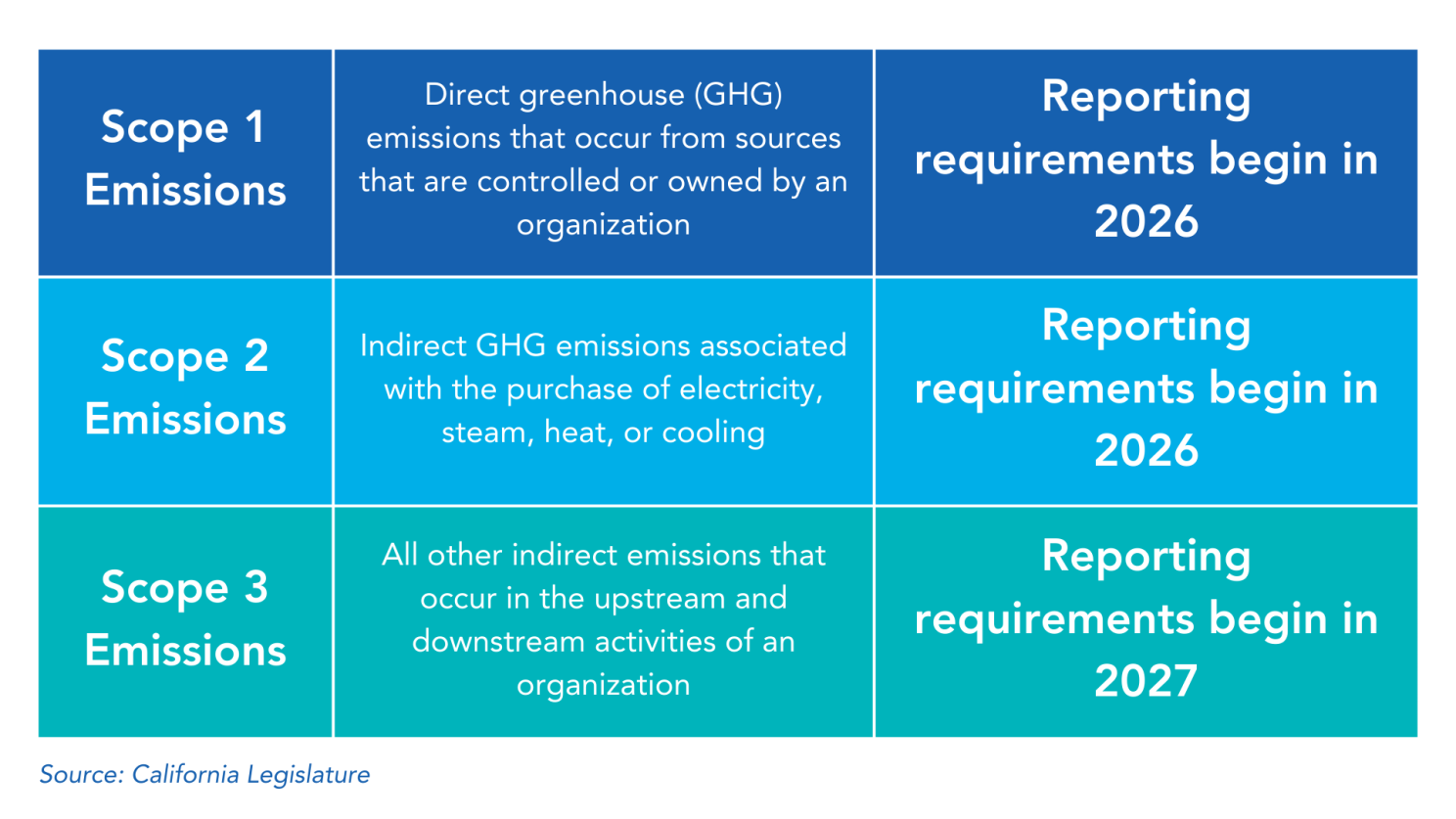

SB 253 specifically mandates that large corporations with annual revenues exceeding $1 billion disclose both direct emissions from their operations and indirect emissions from their value chains. This bill ensures that entities contributing significantly to state-wide emissions implement robust systems for regular reporting.

Senate Bill (SB) 261: Greenhouse Gases: Climate-Related Financial Risk

SB 261 targets companies in pollution-intensive industries or those particularly vulnerable to climate change, such as insurers and financial institutions. Starting in 2026, these companies must integrate thorough financial risk assessments related to climate impacts into their annual financial reports, thereby providing clear insights into potential financial exposures caused by environmental factors.

Assembly Bill (AB) 1305: Voluntary Carbon Market Disclosures

AB 1305 enhances the transparency of the voluntary carbon market by setting guidelines for the voluntary disclosure of carbon credit sourcing, quality, and impact. This bill is particularly relevant for companies involved in carbon credit trading or investment, promoting reliability and preventing misleading claims about carbon neutrality. The scope of these new regulations extends to both large publicly traded companies and certain private entities with significant operations in California. The laws cover businesses that are substantial contributors to carbon emissions or are particularly vulnerable to climate impacts. Companies are required not only to disclose current environmental impacts but also to develop strategies to manage future risks.

Implications for Businesses

California’s climate disclosure laws require immediate changes in business practices, especially in compliance and financial reporting. U.S. companies must now adopt advanced data collection and reporting technologies to transparently share their environmental impacts and associated financial risks, leading to initial investments and potentially higher ongoing operational costs. Despite these expenses, compliance offers significant benefits. It enhances a company’s reputation, attracting environmentally-conscious consumers and investors, which can lead to greater trust and potentially better investment terms. Moreover, these regulations drive innovation in sustainability, pushing companies to develop processes and technologies that minimize environmental impact while improving efficiency and reducing long-term costs. To comply with these laws, companies should conduct comprehensive environmental audits to establish baselines for future reports and adopt environmental data management software. Partnering with environmental consultancies can help set realistic sustainability goals and ensure compliance. Integrating these efforts into wider corporate sustainability strategies not only aids in meeting regulatory requirements but also strengthens overall corporate resilience and adaptability to changing regulations.

Conclusion

California’s new climate disclosure laws are a landmark in U.S. environmental regulation, pushing companies towards greater accountability and sustainable operations. While these laws face challenges from various sectors fearing increased operational burdens, the global trend unmistakably shifts towards enhanced environmental accountability. Early compliance can provide companies with a competitive advantage, fostering innovation, and building investor trust.