Key Takeaways

- Corporate sustainability reporting is the new norm in Singapore and many countries worldwide as ISSB standards are increasingly adopted.

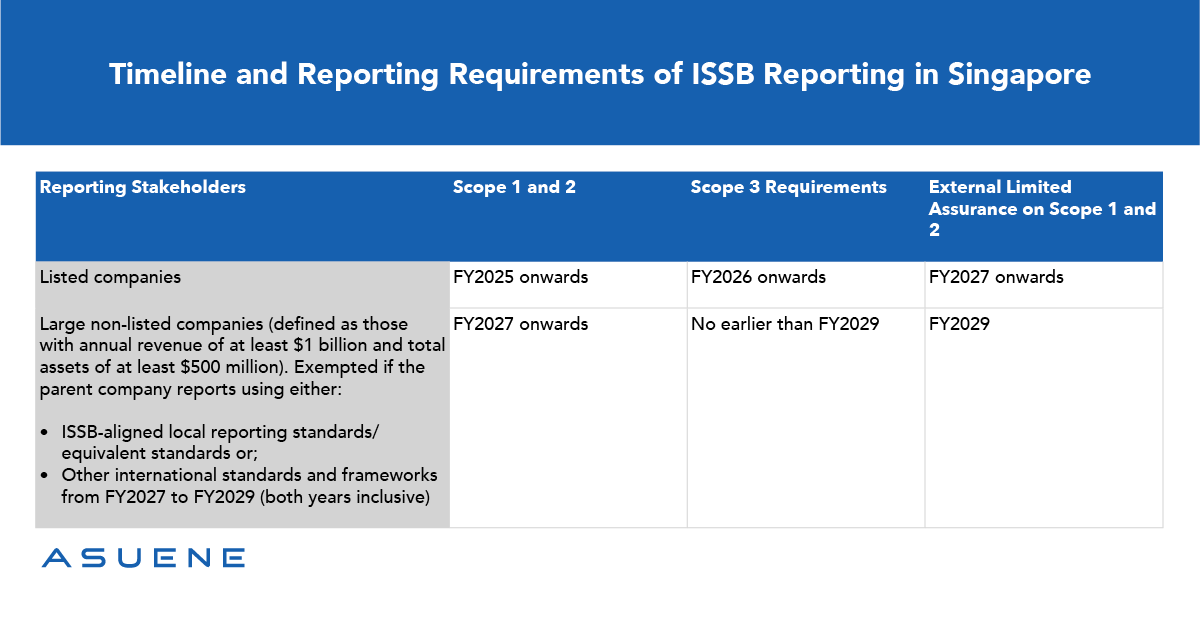

- ISSB reporting is enforced for listed companies and non-listed large companies in Singapore with a phased implementation timeline.

- While reporting is not mandatory for SMEs and non-reporting companies, the government of Singapore has indicated plans to extend reporting requirements.

- Government support and funding are available to support Singaporean companies and SMEs in their sustainability reporting efforts.

Setting the Stage: International Sustainability Standards Board (ISSB) Standards

In June 2023, the International Sustainability Standards Board (ISSB) published the much-awaited disclosure standards that aim to serve as the new global reporting baseline. ISSB was created by consolidating several major reporting organizations and their reporting guidelines, such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Value Reporting Foundation. Designed to standardize investor-focused disclosures, the ISSB Standards have been widely endorsed and adopted by jurisdictions globally. The two ISSB Standards issued so far are IFRS S1 (General Requirements) and IFRS S2 (Climate-Related Disclosures). IFRS S1 is the overarching framework that requires companies to disclose all sustainability-related risks and opportunities. On the other hand, IFRS S2 is a thematic standard focused on climate-related disclosures. Both are effective for reporting periods starting in 2024. Notably, this major reporting standardization at the global level also coincides with the growing momentum of local reporting regulations in the Southeast Asian region. In this article, we will look at the implementation of ISSB-aligned reporting standards in Singapore. As the first country in Asia to adopt ISSB Standards, Singapore is joining the global trend towards ISSB alignment with other countries like Australia, Brazil, the UK, and Japan. Thus, understanding the requirements and development of the new ISSB-aligned reporting regulations is key to staying ahead of the sustainability race in today’s market. To contextualize Singapore’s regulatory landscape, below are the three key milestones in the development of local ISSB-aligned reporting regulations:

- June 2022: The Sustainability Reporting Advisory Committee (SRAC) was established by the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) to develop a sustainability reporting roadmap.

- July – September 2023: The ACRA and SGX RegCo conducted a public consultation on the climate reporting recommendations proposed by SRAC.

- February 2024: Official announcement that mandatory climate-related disclosures will be introduced in a phased approach, in line with the recommendations from the Sustainability Reporting Advisory Committee (SRAC).

About Singapore’s Latest Climate Disclosures

From the 2025 fiscal year onwards, listed companies are expected to report annual climate-related disclosures in line with the ISSB standards. Listed companies should refer to IFRS S1 and IFRS S2 in the preparation of their climate-related disclosures. Furthermore, large non-listed companies, defined as those with annual revenue of at least S$1 billion and total assets of at least S$500 million, will be required to disclose from the 2027 fiscal year onwards. An estimated 943 firms, 643 listed companies and 300 large non-listed companies, are impacted by the new regulations. The table below summarizes the key requirements and timeline for the reporting stakeholders: To ensure timely communication with investors and stakeholders, climate-related disclosures are expected to share the same reporting timelines as financial statements.

Governmental Funding for Companies to Meet New Reporting Requirements

To support companies in meeting the new requirements, the government of Singapore has announced the launch of the Sustainability Reporting Grant. Administered by the Singapore Economic Development Board (EDB) and Enterprise Singapore (EnterpriseSG), the grant program will provide eligible companies with funding to support the production of their first sustainability report. The targeted recipients are large companies with annual revenue of S$100 million and above. The grant is capped at S$150,000 per company or 30 percent of the qualifying costs. In addition to the Sustainability Reporting Grant, other governmental support for decarbonization and energy efficiency initiatives include grants for energy efficiency, green technologies and emission reduction projects.

Beyond Listed and Large Non-Listed Companies: The Far-Reaching Implications of Singapore’s New Reporting Standards

While the reporting requirements only apply to listed and large non-listed companies, the ACRA has stated its intention to use their reporting experience to inform future requirements for other companies. Hence, sustainability reporting is becoming a critical corporate imperative for non-reporting companies as well as small and medium-sized enterprises (SMEs) alike. Importantly, this trajectory has been well echoed by the government’s regulatory plans. In 2023 already, EnterpriseSG was announcing support for CDP disclosure for SMEs. To support further SMEs in their sustainability reporting journey, EnterpriseSG will partner with appointed sustainability service providers to launch a SME-specific programme. The programme is scheduled to launch in 2024 and will run for three years. 70% of the eligible costs for participating SMEs will be covered in the first year of the programme, and 50% of the costs for the next two years. According to a study conducted by the ERM Sustainability Institute, the highest costs associated with climate-related disclosure are greenhouse gas (GHG) analysis, climate scenario analysis, and climate risk management controls. At ASUENE, we are committed to supporting you in your climate disclosure needs and to capitalize on regulatory opportunities. We will share more information about the sustainability reporting landscape in Southeast Asia in our upcoming White Paper. Please keep an eye on our LinkedIn page and website for the publication announcement!